Shares of Outbrain (NASDAQ: OB) crashed 20.4% on May 12, despite beating Wall Street expectations on both the revenue and earnings fronts in Q1. OB stock marked a new all-year low of $5.59 on news of the company lowering its full-year fiscal 2022 guidance.

Outbrain is an American open-source web recommendation platform. Its shares have lost 54.4% year-to-date and have lost nearly 69% of value since its initial listing in July 2021.

Better-Than-Expected Q1 Results

Outbrain reported a break-even quarter against an analyst’s estimated loss of $0.05 per share. In the comparative period last year, OB reported adjusted earnings of $0.20 per share. The lower earnings reflect the higher costs in the quarter related to its initial public offering, merger and acquisition costs and enhanced regulatory expenses.

Similarly, revenue of $254.22 million grew 11% year-over-year and also surpassed the analyst consensus of $242.2 million. The solid revenue growth was driven by a $26 million increase from new media partners.

The company reported an ex-TAC gross profit (adding back other costs of revenue to gross profit) of $63.52, up 5% year-over-year, reflecting higher other costs of revenue in Q1.

Revised 2022 Outlook

Based on the current uncertain economic scenario, Outbrain lowered its ex-TAC gross profit guide to fall in the range of $270 million to $290 million from the earlier range of $324 to $332 million.

Official Comments

Commenting on the company’s future, David Kostman, Outbrain’s Co-CEO, said, “We are lowering our full year 2022 guidance and increasing the size of our range to reflect the demand softness we see, particularly in Europe, and general economic uncertainty. We believe that our strong momentum of publisher partner wins and market share gains in Q1, in addition to our investments in technology and product will position us well for the future. We have a strong balance sheet and are committed to balancing growth and profitability.”

Analysts’ Views

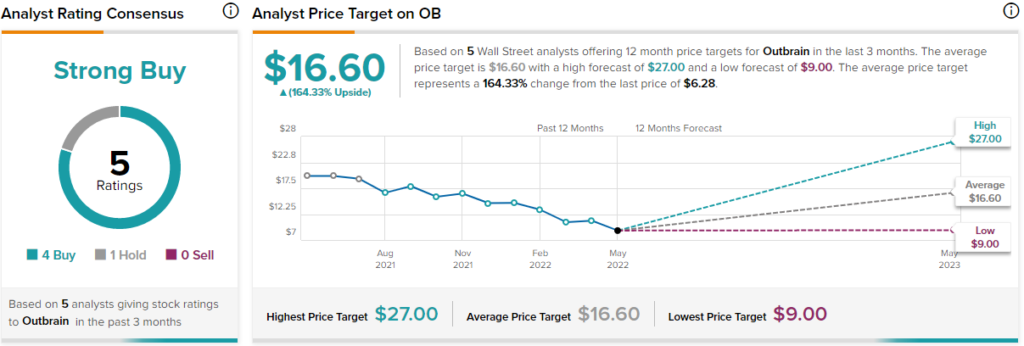

Following Outbrain’s quarterly performance and guidance revision, Needham analyst Laura Martin drastically reduced the price target on the OB stock to $10 (59.2% upside potential) from $20 but maintained a Buy rating.

Martin noted that OB has around 4,000 contract-level clients, giving it exclusive control of consumer-facing content for two to three years. Additionally, OB controls 100% of the content and advertising units on the web pages of its publisher clients, which makes client churn low.

Moreover, OB gets paid on a cost per click (CPC) basis, making it a performance-based advertising platform where it only gets paid if a consumer clicks on an advertisement.

The analyst is concerned about the current soft demand in the ad space from European Union countries, which represents 40% of OB’s revenue due to the ongoing Russia-Ukraine war. “About 20% of OB’s revs have minimum revenue guarantees, which may get triggered if demand softness continues,” added Martin, reflecting her cautious tone on OB’s performance.

The other analysts also have a Strong Buy consensus rating on OB stock, with four Buys and one Hold. The average Outbrain price forecast of $16.60 implies a whopping 164.3% upside potential to current levels, at the time of writing.

Ending Thoughts

Outbrain is getting beaten because of the high regulatory costs associated with being a newly listed company. Moreover, the current geopolitical scenario does not bode well for advertising companies, making it even more difficult to be optimistic about the sector. It would be better to wait on the sidelines till the dust settles and get more clarity on the sector’s trajectory.

Discover new investment ideas with data you can trust.

Read full Disclaimer & Disclosure

Related News:

Amdocs Exceeds Q2 Expectations; Raises FY22 Outlook

AMD, Meta Join Forces to Boost Internet Accessibility

Kohl’s Shareholders Signal Trust in Current Board