MoneyLion Inc. (NYSE: ML) shares jumped 35.5% on May 12 and gained another 10.4% during the extended trading session after the company delivered a blowout first-quarter revenue beat.

Notably, the company reported a fifth consecutive quarter of triple-digit adjusted revenue growth, moved closer to profitability, and reaffirmed its FY2022 guidance.

Investors cheered the second-quarter revenue guidance that was well above analysts’ expectations.

Founded in 2013, MoneyLion is a fintech company that offers lending, financial advisory, and investment services to consumers. Its mobile banking and financial membership platforms empower people to take control of their finances.

Q1 Beat

During the Q1 quarter, MoneyLion’s revenues totaled $69.7 million, up 110% year-over-year, outperforming the consensus estimate of $55.56.

The company added another 645,000 customers in the quarter, which acted as a tailwind. Likewise, total customers grew 117% year-over-year to 3.9 million. Furthermore, MoneyLion continued to grow originations, which jumped 116% to $408 million.

On top of that, gross profit increased 109% to $40.3 million in the first quarter of 2022.

However, the company reported an adjusted earnings before interest, taxes, depreciation and amortization (EBITDA) loss of $24.9 million, compared to the loss of $1.2 million in the prior-year quarter.

Notably, MoneyLion recorded a net income of $0.1 million compared to a loss of $73.4 million for the prior-year quarter.

Reaffirmed FY2022 Outlook

Based on robust Q1 results, management reiterated the financial guidance for FY2021.

The company continues to forecast FY22 revenues to be in the range of $325 to $335 million, implying a growth rate of 100%.

Most importantly, the company is targeting an exit in 2022 with breakeven adjusted EBITDA.

For the fiscal second quarter, revenues are projected to grow 121% year-over-year to be in the range of $78 million to $83 million, versus the consensus estimate of $66.1 million. Adjusted EBITDA is likely to range between ($20) million and ($15) million.

CEO’s Comments

MoneyLion CEO, Dee Choubey, commented, “With the close of our marketplace and media acquisitions, MoneyLion now offers both Consumer and Enterprise solutions.”

He further added, “We expect this business model to diversify our revenue mix substantially as we add enterprise revenues and drive operating leverage through low-cost customer acquisition with powerful network effects.”

Wall Street’s Take

The Wall Street community is cautiously optimistic about the stock, with a Moderate Buy consensus rating based on two Buys. The average MoneyLion price target of $6.50 implies 296.34% upside potential to current levels.

Bloggers Weigh In

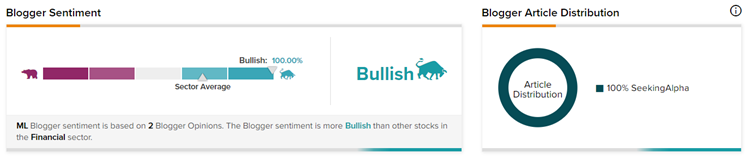

Further, TipRanks data shows that financial blogger opinions are 100% Bullish on ML stock, compared to a sector average of 68%.

Bottom-Line

MoneyLion reported upbeat Q1 revenues with more than a 100% growth rate, which is extremely commendable, especially in current times when bigger fintech companies globally are clearly struggling.

The company is marching towards profitability and remains confident in achieving 100% adjusted revenue growth in 2022 and breakeven adjusted EBITDA.

No wonder investors’ interest in the shares shot up, almost doubling the share price post earnings.

Discover new investment ideas with data you can trust.

Read full Disclaimer & Disclosure

Related News:

Why Did Unity Software Shares Drop Almost 25%?

Roblox Shares Drop 4.4% on Q1 Miss

Philip Morris Will Acquire Swedish Match AB for $16B