Shares of Illumina, Inc. (ILMN) declined more than 15% in the extended trading session on August 11 after the company delivered weaker-than-expected second-quarter results and lowered its guidance for FY2022.

Based in California, Illumina develops, manufactures, and markets integrated systems for the analysis of genetic variation and biological function. It serves customers in the research, clinical, and applied markets, allowing the adoption of a variety of genomic solutions.

A Snapshot of Q2 Results

The company reported adjusted earnings of $0.57 per share, which lagged analysts’ expectations of $0.64 per share. Illumina had posted earnings of $1.87 per share in the same quarter last year.

Meanwhile, revenues grew 3% year-over-year to $1.16 billion but fell short of consensus estimates of $1.22 billion.

Despite the Q2 miss, Illumina CEO Francis deSouza shared his optimism. He said, “As we strategically navigate these dynamics, we continue to advance our innovation roadmap in support of our long-term growth trajectory. At our upcoming Illumina Genomics Forum and Investor Day events, we look forward to showcasing our breakthrough technologies that demonstrate the power and potential of genomics.”

Ilumina Slashes Outlook for FY22

Based on the current macroeconomic scenario, customer lab expansion delays, and unfavorable currency effect, the company has slashed its financial guidance for FY2022.

Illumina now forecasts adjusted earnings in the range of $2.75 to $2.90 per share, lower than the prior outlook of $4-$4.20 and the consensus estimate of $4.13 per share.

Further, revenues are now forecast to grow 4% to 5%, compared to the previously guided range of 14% to 16%.

Is ILMN a Buy Or Sell?

At present, Illumina is neither a Buy nor a Sell. On TipRanks, the stock has a Hold consensus rating based on three Buys, four Holds, and 1 Sell. Illumina’s average price target of $295.71 implies 30% upside potential from current levels.

Following the company’s disappointing second-quarter results, JPMorgan analyst Tycho Peterson reiterated a Hold rating on the stock and reduced his price target to $300 (31.9% upside potential) from $350.

Although the stock has lost more than half of its market capitalization over the past year, it has recovered in the past 30 days.

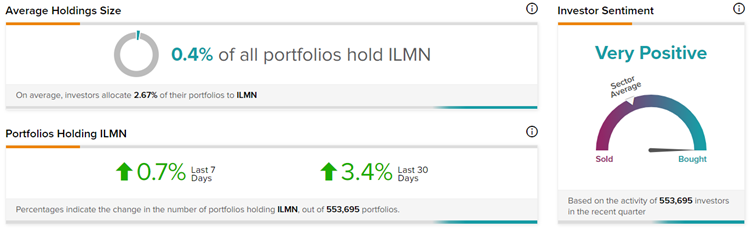

In fact, TipRanks’ Stock Investors tool shows that retail investors have a Very Positive stance on Illumina, with 3.4% of investors increasing their exposure to ILMN stock over the past 30 days.

As of now, our analysis says that prospective investors may want to remain on the sidelines until they see some more signs of recovery.

Read full Disclosure