Last week, Bryan Giraudo (COO/CFO of Gossamer Bio), Faheem Hasnain (President & CEO), Laura Carter (Chief Scientific Officer), and Christian Waage (EVP, Tech Ops and Admin) bought shares of Gossamer Bio, Inc. (Nasdaq: GOSS) worth around $1.2 million. This attracted investors’ attention and the shares of the clinical-stage biopharmaceutical company gained about 2.2% in the pre-market trading session on Monday.

It is worth noting that Gossamer Bio informed stakeholders about its $120 million private placement financing plans on July 13. The company had agreed to sell nearly 16.6 million shares of its common stock at $7.21 per share to a select group of institutional and accredited investors in a private placement by July 15.

New and existing institutional investors, comprising EcoR1 Capital, New Enterprise Associates (NEA), Weiss Asset Management, Madison Avenue Partners, Rock Springs Capital, Boxer Capital, Invus, and Monashee Investment Management, and some directors and executive officers of Gossamer participated in the financing plan. Investors who participated in the financing scheme entered into lock-up agreements with Gossamer to limit their ability to sell Gossamer shares.

According to Faheem Hasnain, the Chairman, Co-Founder and CEO of Gossamer, “These additional funds will allow us to accelerate and expand our investment in seralutinib ahead of the Phase 2 TORREY Study topline results in the fourth quarter of this year.”

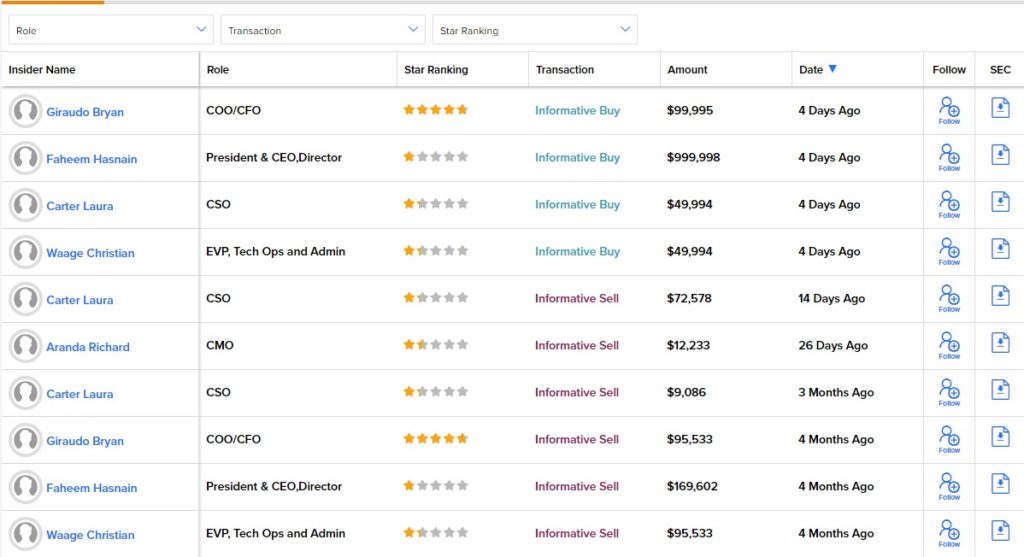

According to TipRanks, which also provides a comprehensive list of daily insider transactions, various corporate insiders have sold GOSS stock worth $454,565 in the last four months.

A pictorial representation of these transactions is provided below:

Insider Confidence Signal is Neutral on GOSS

TipRanks’ Insider Trading Activity tool shows that insiders are currently Neutral on GOSS. Further, corporate insiders have bought GOSS stock worth $1.1 million in the last three months.

Interestingly, TipRanks also provides a list of hot stocks that commands either a Very Positive or Positive insider confidence signal.

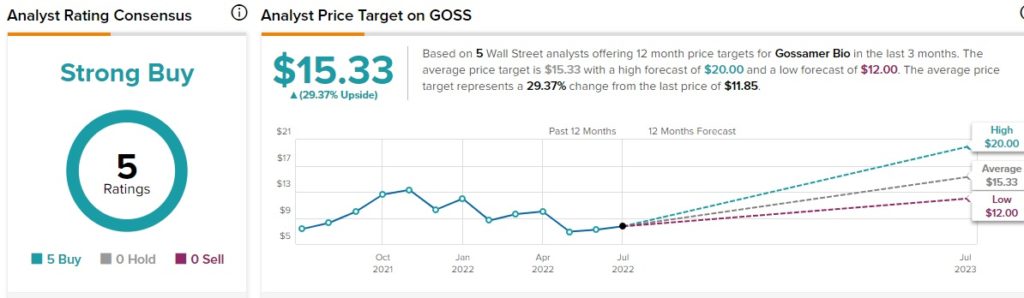

Street Has A Strong Buy on GOSS Stock

Overall, the Street is very optimistic about the stock and has a Strong Buy consensus rating based on five Buys. Gossamer Bio’s average price forecast of $15.33 signals that the stock may surge nearly 29.4% from current levels. Shares of GOSS have slipped around 6.8% so far this year.

Gossamer Bio scores a 9 out of 10 on TipRanks’ Smart Score rating system, indicating that the stock has strong potential to outperform the market.

TipRanks data shows that retail investors are Very Positive about the stock, as their holdings in GOSS stock have increased 8.2% in the last 30 days.

Key Takeaway for Gossamer’s Stakeholders

The recent privately raised funding will allow GOSS to increase its investments in the seralutinib program. The proceeds from the funding, along with current cash, cash equivalents and marketable securities, and access to the debt facility are predicted to sufficiently meet the operating and capital expenditures into mid-2024.

Read full Disclosure