The multinational banking behemoth, Citigroup (NYSE: C), surprisingly exceeded second-quarter expectations on both the earnings and revenue fronts. Shares surged 14.7% on the news and ended the day up 13.2% at $49.98 on July 15.

The bank benefited from the increased interest rate environment, which boosted its net interest income (NII). Additionally, increased client activity in the markets boosted fees as trading volumes remained elevated. This, coupled with continued momentum in the U.S. card business, augmented its revenues.

Citigroup CEO, Jane Fraser, commented, “Treasury and Trade Solutions fired on all cylinders as clients took advantage of our global network, leading to the best quarter this business has had in a decade. Trading volatility continued to create strong corporate client activity for us, driving revenue growth of 25% in Markets.”

Citi’s Q2 Results Exceeded Estimates

Citigroup reported diluted earnings of $2.19 per share, which is significantly higher than the consensus of $1.67 per share. However, the earnings came in much lower than the prior year’s figure of $2.85 per share.

Furthermore, total revenue of $19.64 billion jumped 11% year-over-year and also outpaced analysts’ estimates of $18.32 billion. Total revenue also showed a modest 2% increase over the Q1 figure.

Q2 NII of $11.96 billion grew 14% year-over-year and 10% compared to Q1 FY22. Whereas the non-interest income of $7.67 billion rose 5% compared to the prior year quarter but fell 8% sequentially. Meanwhile, the provision for credit losses was $1.27 billion (expense), compared to a release of reserves (benefit) of $1.07 billion in the comparative period.

Wall Streets Is Cautiously Optimistic about Citi

Despite the quarterly beat, Barclays analyst Jason Goldberg cut the price target on C stock to $64 from $67 while maintaining a Hold rating.

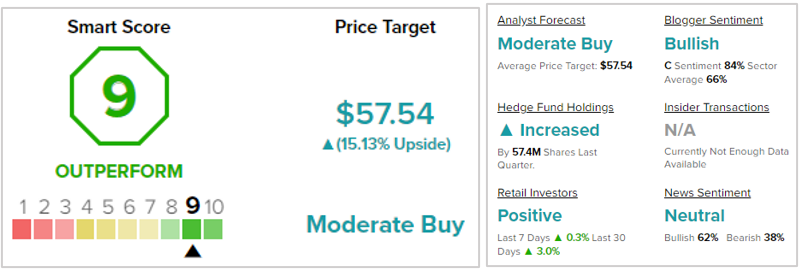

Amid market turbulence, the Street is cautiously optimistic about the stock with a Moderate Buy consensus rating based on six Buys, six Holds, and one Sell. The average Citigroup price target of $57.54 implies 15.1% upside potential to current levels. Meanwhile, the stock has lost 19.3% year to date.

Citi Stock Analysis

According to TipRanks’ Smart Score, Citigroup has a score of nine, indicating that the stock is very likely to outperform the market. Bloggers are bullish on the stock, and hedge funds have increased their holdings of C stock by a whopping 57.4 million shares in the last quarter. Retail investors have also increased their exposure to C stocks by 3% over the last 30 days.

Ending Thoughts

Citigroup has pleasantly surprised investors with its quarterly beat, especially after the other two of the “Big Four” banks missed their expectations. CEO Fraser is particularly confident about Citi’s performance in the challenging macro and geopolitical environment. “Our team delivered solid results and we are in a strong position to weather uncertain times, given our liquidity,” she noted.

During the quarter, the bank returned $1.3 billion to shareholders in the form of dividends and share buybacks. Citi boasts a current dividend yield of 4.08%, which makes a compelling case for investors.