Aon Plc. (AON) has delivered mixed results for the first quarter of 2022, as earnings topped, but revenues fell short of, expectations. Shares of the company declined 9.4% to close at $287.99 on April 29.

The professional services company offers financial risk mitigation products, including insurance and pension administration.

Results in Detail

Revenues in the quarter were up 4% year-over-year to $3.7 billion, slightly missing consensus estimates of $3.73 billion. The increase in revenues was supported by an 8% rise in organic revenue, driven by ongoing strong retention and net new business generation.

Adjusted earnings per share increased 18% year-over-year to $4.83, beating the consensus estimate of $4.80. Also, the adjusted operating margin climbed 60 basis points to 38%.

CEO Greg Case said, “Our performance demonstrates how increasing global volatility has further reinforced the relevance of our Aon United strategy. In the face of rising complexity and uncertainty, our colleagues will continue to employ the advanced analytics and underlying technology of our Aon Business Services platform to identify areas of unmet need, improve service standards, and accelerate delivery of new solutions that provide clients the clarity and confidence they need to protect and grow their business.”

AON repurchased 2.8 million Class A ordinary shares for about $0.8 billion during the quarter. Further, it announced a $7.5 billion increase in share repurchase authorization and a 10% increase in quarterly cash dividend.

Stock Rating

On May 1, Wells Fargo analyst Elyse Greenspan assigned a Hold rating to the stock with a $310 price target, implying 7.6% upside potential from current levels.

The analyst did not change estimates for 2022, however, she lowered her estimates for 2023 “to reflect modestly higher interest expense, higher repurchase prices, greater fiduciary income, and slightly lower organic revenue.”

Consensus among analysts is a Hold based on four Holds. AON’s average price target of $313.75 implies 8.9% upside potential to current levels.

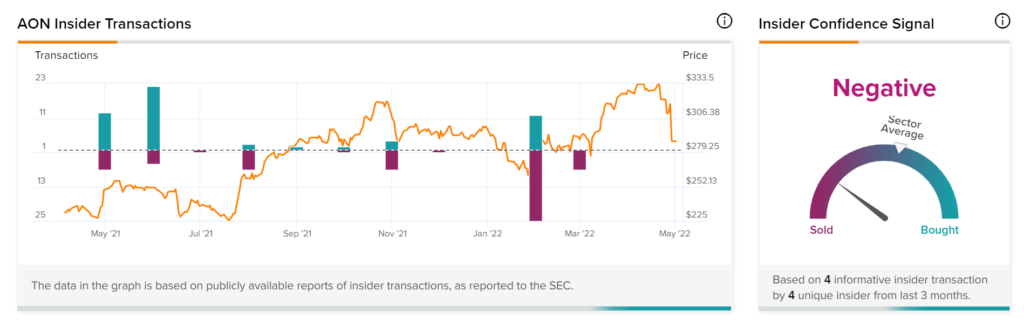

Insider Trading Activity

Based on the recent corporate insider activity, sentiments seem to be Negative on AON. This means that over the past quarter there has been an increase in insiders selling their shares of Aon.

Conclusion

Despite a decent quarterly performance, negative sentiments of hedge funds and insiders make Aon a less attractive investment option.

Discover new investment ideas with data you can trust.

Read full Disclaimer & Disclosure

Related News:

Chevron Slips 3% Despite Strong Q1 Results

Why Did AbbVie Stock Fall Despite FDA’s Approval?

Why Does Warren Buffett Favor Occidental Petroleum?