Levi Strauss & Co (LEVI) shares gained almost 5% during the extended trading session on July 7 after the creator of denim jeans delivered impressive second-quarter results and also reiterated its FY2022 guidance.

What’s more, the U.S.-based clothing company also rewarded its investors with a 20% dividend hike.

Q2 Beat for Levi

Notably, adjusted earnings of $0.29 per share exceeded analysts’ expectations of $0.23 per share. The company reported earnings of $0.23 per share in the prior-year period.

Furthermore, revenues jumped 14.8% year-over-year to $1.47 billion and exceeded consensus estimates of $1.43 billion. The increase in revenues reflected a surge in Direct-to-Consumer net revenue, which gained 16%, coupled with a 15% growth in Global Wholesale net revenue.

Positively, the adjusted operating margin came in at a record 9.9%, growing 90 bps from 9.0% in the prior-year quarter.

Reiterated FY2022 Outlook

Despite a difficult macro environment, the company reiterated its outlook for FY2022.

The company continues to forecast FY2022 adjusted earnings in the range of $1.50 per share to $1.56 per share, while the consensus estimate is pegged at $1.55 per share. Revenues are projected to grow between 11% and 13% year-over-year in the range of $6.4 billion to $6.5 billion, compared to the consensus estimate of $5.68 billion.

Levi’s Hikes Dividends

Levi Strauss raised its quarterly dividend by 20% to $0.12 per share from $0.10 paid earlier.

The dividend is payable on August 17 to shareholders on record as of June 30. The annual dividend of $0.48 per share now reflects a dividend yield of 2.21%.

CEO’s Comments

Levi Strauss CEO, Chip Bergh, commented, “Our brands are resonating with consumers across geographies, channels and product categories. By continuing to advance our most impactful growth drivers – being brand-led, direct to the consumer first and diversifying the portfolio, we are well-positioned to continue to drive growth and create significant value for all our stakeholders.”

Wall Street’s Take

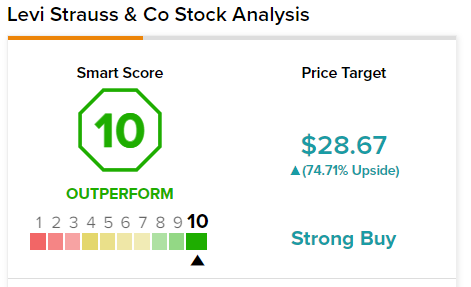

Overall, the stock has a Strong Buy consensus rating based on three unanimous Buys. The average Levi Strauss price target of $28.67 implies a whopping 74.71% upside potential from current levels.

TipRanks’ Smart Score

LEVI scores a “Perfect 10” on TipRanks’ Smart Score rating system, indicating that the stock has strong potential to outperform market expectations.

Concluding Thoughts

Levi reported an upbeat Q2 result with margin expansion amidst ever rising inflation and tightening consumer budgets, which is commendable.

Furthermore, CFO Harmit Singh shared his bullish outlook and stated, “Although the operating environment remains dynamic, the diversity of our business is providing the resilience and flexibility needed to drive solid financial results in fiscal year 2022, while progressing us on our path to achieve net revenues of $9 to $10 billion and adjusted EBIT margin of 15% by fiscal year 2027.”

The earnings beat as well as strong management confidence on the bright future prospects bodes well for the stock.