Albemarle Corporation (NYSE: ALB) took the market by surprise after it increased its projections for full-year 2022. Successful renegotiations of lithium contracts, post the first-quarter earnings release earlier this month, drove the revision.

Shares of this $28.5-billion specialty chemical company grew 2.8% to close at $242.94 on Monday. The stock advanced an additional 2.5% in the extended trading session.

Inside the Headlines

Albemarle now projects 2022 revenues to be in the range of $5.8 billion to 6.2 billion, higher than the earlier projection of 5.2 billion to $5.6 billion.

Realized pricing (average) is now expected to be up 140% from the year-ago quarter, while volume is likely to expand 20%-30% year-over-year.

Adjusted earnings are expected to be $12.30 per share to $15 per share in the year versus the previous forecast of $9.25 per share to $12.25 per share.

The company expects adjusted earnings before interest, tax, depreciation, and amortization (EBITDA) to be within the $2.2 billion to $2.5 billion range, up from the previous expectation of $1.7 billion to $2 billion. The adjusted EBITDA margin is likely to wary from 38% to 40% versus 33% to 36% expected earlier.

In the year, net cash from operating activities is predicted to be $550 million to $850 million, higher than the previous expectation of $500 million to $800 million. Capital expenditure expectation is maintained at $1.3 billion to $1.5 billion.

The CEO of Albemarle, Kent Masters, said, “We now expect full-year 2022 adjusted EBITDA to be up more than 160% from prior year based on favorable market dynamics for our Lithium and Bromine businesses. Both businesses are critical for transitioning to greener energy and advancing electrification and digitalization.”

Stock Rating

A few days ago, Michael Sison of Wells Fargo revised its rating on ALB to Buy from Hold while maintaining a price target of $285 (17.31% upside potential).

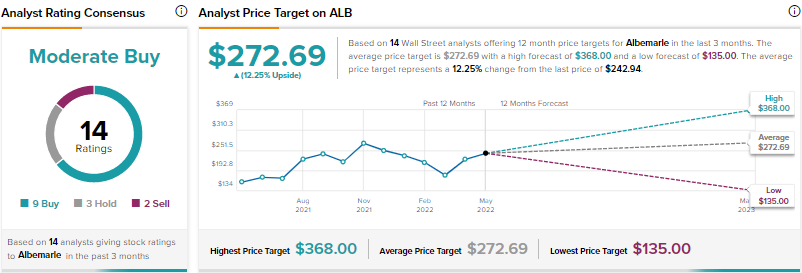

Overall, the Street has a Moderate Buy consensus rating on ALB based on nine Buys, three Holds, and two Sells. Albemarle’s average price target of $272.69 suggests 12.25% upside potential from current levels.

Crowd Wisdom

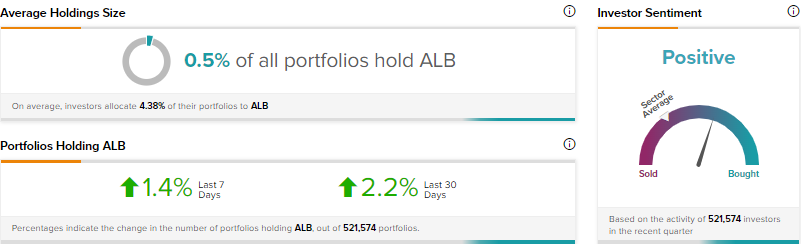

Data compiled by TipRanks suggests that investors are Positive about Albemarle, as 2.2% of investors on TipRanks increased their holdings in ALB stock in the past 30 days.

Conclusion

Albemarle is well-positioned to leverage healthy demand in the prime end markets that it serves. Also, its execution capabilities, growth opportunities in Europe and North America, and contract renegotiation efforts are expected to prove advantageous.

Discover new investment ideas with data you can trust.

Read full Disclaimer & Disclosure

Related News:

Nvidia: Why Investors Should Temper Expectations Ahead of Earnings

Veeva Systems: Analysts See Over 50% Upside Potential

Deere Hits All-Time Low Despite Q2 Beat