The Court sets the Trial Date on the Elon Musk Issue

Last Update (01/08/2022)

The court has set a date for Twitter’s (TWTR) lawsuit against Tesla’s (TSLA) CEO, Elon Musk. The trial is set to begin on October 17 and will run for five days in the Delaware Chancery Court.

In April, Musk agreed to acquire Twitter for $44 billion in a deal that valued the company at $54.20 per share. In July, the billionaire changed his mind and now wants to terminate the agreement. Musk’s complaints include that Twitter has underestimated the number of fake accounts on its platform. The billionaire has also accused the social media company of violating their agreement by cutting some jobs without involving him. Twitter has sued to force Musk to complete the transaction.

Twitter Calls for a Vote on Musk’s Deal Before the Court Fight Begins

The social media company has set September 13 as the date for its shareholders to vote on its buyout deal by Musk. It has asked shareholders to vote in favor of completing the transaction. The vote is set to take place ahead of the beginning of the court fight over Musk’s attempt to walk away.

The company revealed in its Q2 2022 earnings report that its weak performance was partly caused by uncertainty over the pending buyout deal. Twitter also disclosed that it incurred $33 million in costs related to the pending acquisition.

Analysts Recommend a Hold on Twitter Stock

On July 30, Wells Fargo analyst Brian Fitzgerald reiterated a Hold rating on the Twitter stock with a price target of $54.20, which indicates 30% upside potential.

With two Buys and 16 Holds, Twitter stock has a Hold consensus rating. The average Twitter price target of $39.89 implies 4% downside potential from current levels.

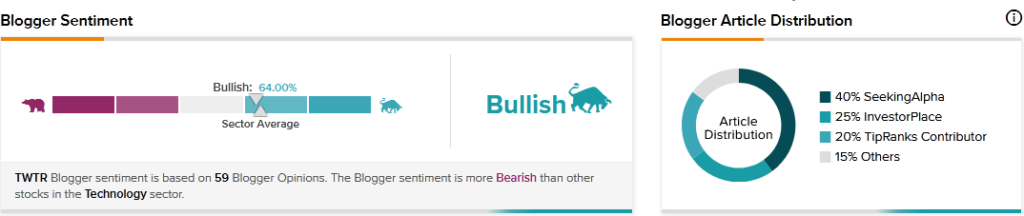

Bloggers Are Fairly Bullish on TWTR

TipRanks data shows that financial blogger opinions are 64% Bullish on TWTR, compared to a sector average of 65%.

Key Takeaway for Investors

The scheduling of the shareholder vote and the board’s call for support for the pending buyout deal is the latest sign that Twitter is seeking to compel Musk to honor his original commitment. However, if its shareholders decided to vote against the acquisition, the company would be in a weaker position to defend itself in the pending court trial with Musk.

Read full Disclosure