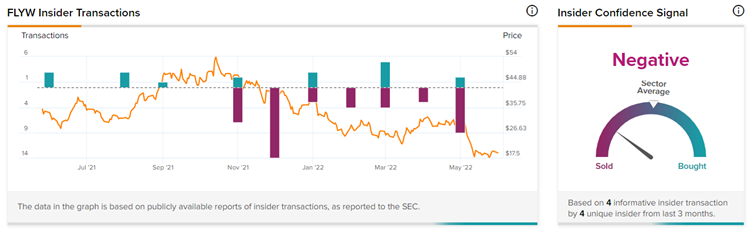

There has been vehement insider selling on Flywire (NASDAQ: FLYW) stock recently.

Flywire is a global payments enablement and software company, offering its clients an innovative and streamlined process to receive reconciled domestic and international payments in a more cost-effective and efficient manner.

Notably, the company has lost half of its market capitalization over the past six months and now has a market cap of $2 billion.

Yesterday, Director Jo Natauri sold 905,192 shares of FLYW stock worth $17.93 million at $19.70 price levels.

In fact, Jo is an employee at Goldman Sachs and has sold a large number of shares over the past fortnight in three separate transactions worth another $9.4 million. Jo now holds 1.91 million shares worth $38.14 million after the series of Sells.

Besides Jo, FLYW Director Riese Phillip John made an uninformative Sell of 5,000 shares of the stock worth $95,974 at $19.19 price levels, and now holds 7,290 shares worth $145,840.

Insiders at Flywire are clearly pessimistic about the stock’s near-term prospects and have sold a whopping $27.2 million worth of shares in the past three months.

Wall Street’s Take

Despite the Insider Selling, Flywire has a Strong Buy consensus rating on Wall Street based on seven Buys and one Hold assigned in the past three months. The average Flywire price target of $35.50 implies 83.84% upside potential.

Investor Sentiment

Investors, however, are likely follow in the footsteps of the insiders. At the time of writing, TipRanks’ Stock Investors tool shows that investors currently have a Very Negative stance on FLYW, with 4.2% of investors decreasing their exposure to FLYW stock over the past 30 days.

Conclusion

Insider trading makes it possible to quickly find and track insiders’ moves, and is well presented with the TipRanks Insiders’ Hot Stocks tool.

The company’s Director shedding off almost half of her ownership within a month is a clear indication of the declining confidence she has in the future growth prospects of the stock.

Read full Disclosure