Incyte (INCY) is an American multinational drug developer. It has secured FDA approval for several of its products, including Jakafi, which treats chronic graft-versus-host disease in adults and children aged 12 and older. Incyte has more products in the pipeline, including parsaclisib, for which it has sought FDA approval as a treatment for relapsed non-Hodgkin lymphoma in adults.

Incyte reported revenue of $813 million for Q3 2021 versus $620.6 million in the same quarter last year and exceeded the consensus estimate of $738.5 million. It posted adjusted EPS of $1.18, which rose from $0.23 in the same quarter last year and beat the consensus estimate of $0.72. Incyte ended Q3 with $2.3 billion in cash.

With this in mind, we used TipRanks to take a look at the risk factors for Incyte.

Risk Factors

According to the new TipRanks Risk Factors tool, Incyte’s main risk category is Legal and Regulatory, representing 27% of the total 41 risks identified for the stock. Tech and Innovation and Ability to Sell are the next two major risk categories at 24% and 22% of the total risks, respectively. Incyte has recently added one new Legal and Regulatory risk factor.

Incyte informs investors that the White House and Congress are considering significant changes to the existing U.S. tax laws. It has also cited the 2021 agreement by OECD countries on a global minimum corporate tax rate. The company cautions that the changes in tax regulations being pursued domestically and internationally could increase its tax liability and cause adverse impacts on its operating results and financial condition.

In an updated Ability to Sell risk factor, Incyte reminds investors that it relies on a small number of specialty pharmacies and wholesalers for a significant portion of its drug sales, including for its flagship Jakafi. The pharmacies sell the drugs to patients with prescriptions. On the other hand, wholesalers distribute the drugs to hospitals and doctor’s offices. The company warns that a loss of a pharmacy or wholesaler partner may result in the loss of revenue and an increase in costs.

The Legal and Regulatory risk factor’s sector average is 20%, compared to Incyte’s 27%. Incyte’s stock has declined about 16% over the past year.

Analysts’ Take

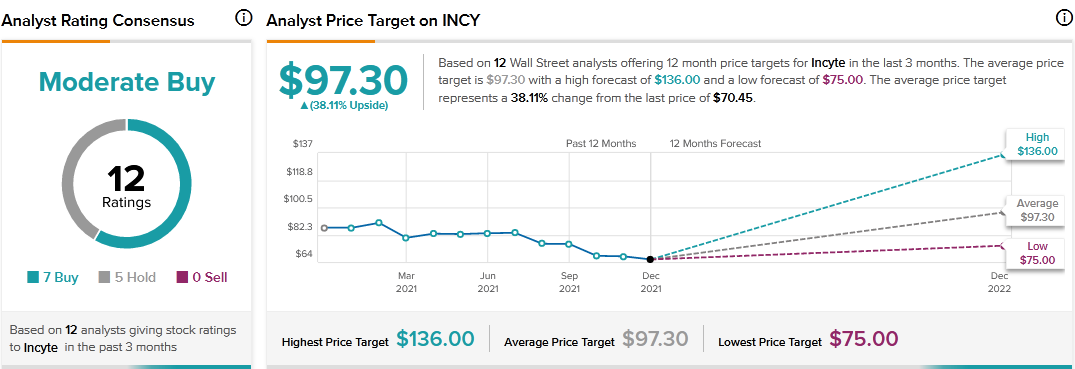

Guggenheim analyst Michael Schmidt recently reiterated a Buy rating on Incyte stock but lowered the price target to $104 from $118. Schmidt’s reduced price target still suggests 47.62% upside potential.

Consensus among analysts is a Moderate Buy based on 7 Buys and 5 Holds. The average Incyte price target of $97.30 implies 38.11% upside potential to current levels.

Download the TipRanks mobile app now.

Related News:

Supermarket Income REIT Buys 2 U.K. Supermarkets

Voyager Digital Announces Estimated Revenue for Q2

High Tide Buys Cannabis Store Bud Room