Crocs (CROX) is an American casual footwear company that sells its products around the world. (See Top Smart Score Stocks on TipRanks)

Let’s take a look at the company’s latest financial performance, corporate updates, and risk factors.

Q3 Financial Results

Crocs reported revenue of $626 million for Q3 2021. That compared to $362 million in the same quarter last year and surpassed the consensus estimate of $610.01 million. It posted adjusted EPS of $2.47, compared to $0.94 in the same quarter last year, and beat the consensus estimate of $1.88. (See Crocs stock charts on TipRanks).

Crocs repurchased $150 million worth of its shares in Q3 and expects to repurchase $1 billion worth of its shares in 2021. It ended Q3 with $436.6 million in cash and $499.7 million in borrowing capacity.

Corporate updates

The company has issued senior notes maturing in 2031 to raise $350 million. It plans to use the money to fund its stock repurchase program and potential acquisitions.

Crocs has hired former Victoria’s Secret and American Eagle Outfitters (AEO) executive Lori Foglia as its chief product and merchandising officer. Foglia joins Crocs to help the company achieve its target of reaching $5 billion in annual revenue by 2026. Revenue was about $1.4 billion in 2020.

Crocs has committed to becoming a net-zero company by 2030. To achieve this goal, the company is focusing on sustainable ingredients and packaging while investing in product afterlife solutions.

Risk Factors

A total of 32 risk factors have been identified for Crocs, according to the new TipRanks Risk Factors tool. Since September 2021, the company has updated its risk profile with one new risk factor under the Production category.

Crocs cautions that supply chain disruptions could adversely affect product manufacturing and increase costs. The company tells investors that it relies on third-party factories outside the U.S. to produce its products. Once manufactured, the products need to be shipped to various markets. The company says it has experienced manufacturing and shipping disruptions because of the COVID-19 pandemic. For example, some of the factories that manufacture its products were shut down for weeks in Q3. Crocs expects supply chain challenges to persist into 2022, which may cause delays in getting products to customers, leading to revenue loss. Shipping delays may also cause Crocs to resort to air freight, which is more expensive and would increase freight costs.

The majority of Crocs’ risk factors fall under the Finance and Corporate category, with 25% of the total risks. That is below the sector average of 40%. Crocs’ stock price has gained 139% year-to-date.

Analysts’ Take

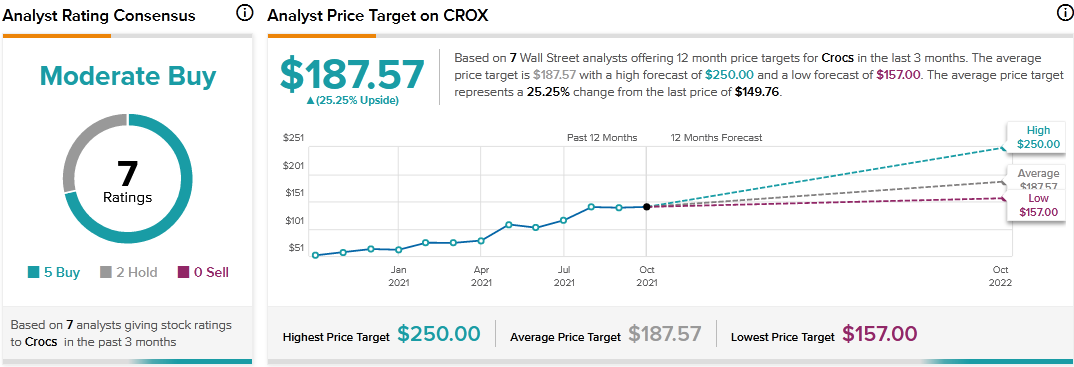

Following Crocs’ Q3 report, Stifel Nicolaus analyst Jim Duffy reiterated a Hold rating on Crocs stock and raised the price target to $157 from $151. Duffy’s new price target suggests 4.83% upside potential. The analyst noted that the Q3 performance was impressive.

Consensus among analysts is a Moderate Buy based on 5 Buys and 2 Holds. The average Crocs price target of $187.57 implies 25.25% upside potential to current levels.

Related News:

23andMe to Acquire Lemonaid Health for $400M

Roper Technologies Posts Mixed Q3 Results

Simply Good Foods Rise 8.6% as Q4 Results Top Estimates