Shares of Cinedigm Corp. (CIDM) have gained about 25% over the past month after the company posted strong Q4 results. Cinedigm provides premium content, enthusiast streaming channels, and technology services to media, retail, and technology companies globally.

Let’s take a look at Cinedigm’s financial performance and what has changed in its key risk factors that investors should be aware of.

Driven by 197% growth in streaming channel revenue, 331% growth in Ad-supported streaming channel revenue, and 117% growth in subscription streaming channel revenue, Cinedigm’s Q4 revenues climbed 6.8% year-over-year to $8.3 million.

The Chairman and CEO of Cinedigm, Chris McGurk, said, “Our streaming/digital business was 75% of our total revenues during the quarter and we expect that percentage will continue to increase as we grow the business both organically and through our streaming acquisition roll-up strategy. In addition, we reduced our debt significantly and recently announced we now have zero debt and our strongest ever overall balance sheet position.”

Moreover, Cinedigm also narrowed its net loss per share to $0.04 from $0.08 a year ago. (See Cinedigm stock chart on TipRanks)

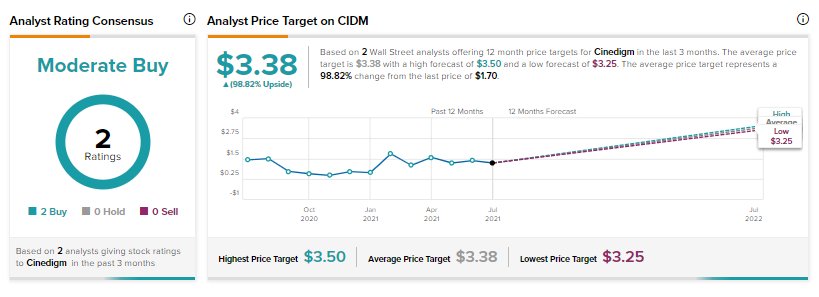

On August 2, Alliance Global Partners analyst Brian Kintslinger reiterated a buy rating on Cinedigm and increased the price target to $3.25 from $3. Kintslinger expects continued growth acceleration for Cinedigm on the back of stronger inventory fill rates, more channels, increased viewership, and subscriber numbers.

Benchmark Co’s Daniel Kurnos too has a Buy rating on the stock. Kurnos has assigned a price target of $3.50 to the stock.

The two ratings add up to a Moderate Buy consensus. The average Cinedigm price target of $3.38 implies 99% upside potential. Shares are up 154% so far this year.

Now, let’s look at what has changed in the company’s key risk factors profile.

According to the new Tipranks’ Risk Factors tool, Cinedigm’s main risk category is Finance & Corporate, which accounts for 64% of the total 36 risks identified. Since March, the company has added one key risk factor under the Finance & Corporate category.

The company acknowledges that it has identified two material weaknesses in its internal control over financial reporting and may not be able to prevent or detect a material misstatement of annual or interim financial statements in a timely manner.

The first identified weakness is that Cinedigm has limited accounting personnel with sufficient expertise in accounting knowledge and training in the U.S. generally accepted accounting principles, and financial reporting requirements.

The second weakness is ineffective control over information and communication. If Cinedigm fails to provide timely and accurate information, investor confidence may weaken and impact the stock price negatively.

The Finance & Corporate risk factor’s sector average is at 41%, compared to Cinedigm 64%.

Related News:

What Do IMAX’s Risk Factors Indicate?

Vista Outdoors Shares Jump on Blowout Q1 Results

Pfizer Delivers Blowout Quarter, Raises Guidance