Pennsylvania-based Aramark Holdings (ARMK) provides food, facilities, and uniform services to a diverse range of customers across 19 countries. Its customers include schools, hospitals, sports teams, and other businesses.

In an expansion move, Aramark has recently acquired Wilson Vale, a U.K-based foodservice company. Aramark believes the acquisition will bolster its U.K. business. Wilson Vale is expected to continue with its existing leadership team and operate as an autonomous brand of Aramark.

For Fiscal Q4 2021 ended October 1, Aramark reported a 32% year-over-year increase in revenue to $3.6 billion, surpassing the consensus estimate of $3.3 billion. It posted adjusted EPS of $0.21, beating the consensus estimate of $0.19.

Aramark ended Q4 with $2 billion in cash. The company recently distributed a quarterly dividend of $0.11 per share. Aramark stock currently offers a dividend yield of 1.2%, compared to the sector average of 0.45%.

With this in mind, we used TipRanks to take a look at the risk factors for Aramark.

Risk Factors

According to the new TipRanks Risk Factors tool, Aramark’s main risk categories are Finance & Corporate and Production, each representing 28% of the 29 total risks identified for the stock. Legal & Regulatory and Macro & Political are the next two major risk categories at 21% and 14%, respectively. Aramark recently updated its profile with one new risk factor under the Legal & Regulatory category.

As a multinational business, Aramark explains that it is subject to complex tax regulations. It cautions that changes in tax rules could adversely affect its financial results. The company mentions that the U.S. is considering increasing the corporate tax rate and changing how foreign profits are taxed.

The Finance & Corporate risk factor’s sector average is 37%, versus Aramark’s 28%. Aramark’s stock has declined about 3% over the past year.

Analysts’ Take

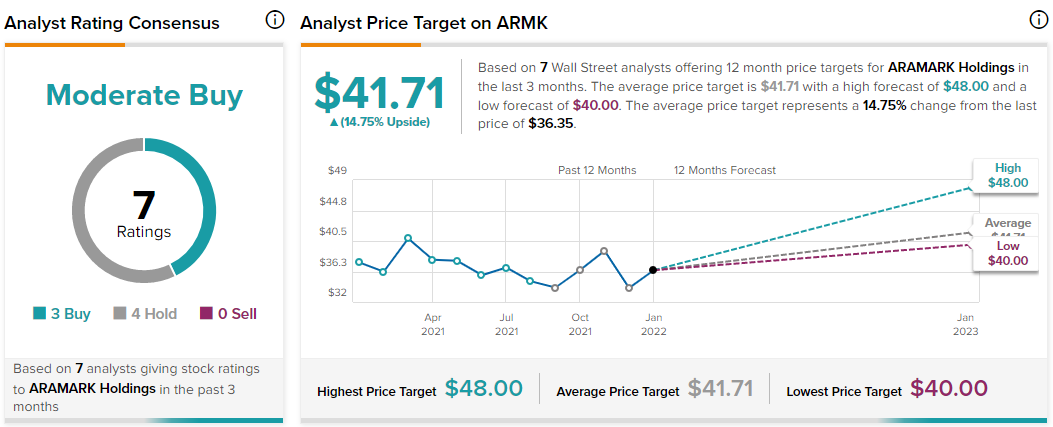

RBC Capital analyst Ashish Sabadra recently reiterated a Hold rating on Aramark stock with a price target of $41, which suggests 12.79% upside potential.

Consensus among analysts is a Moderate Buy based on 3 Buys and 4 Holds. The average Aramark price target of $41.71 implies 14.75% upside potential to current levels.

Download the TipRanks mobile app now.

Read full Disclaimer & Disclosure