Ohio-based American Electric Power (AEP) is a public utility company that is focused principally on generating, transmitting and distributing electricity. It is one of the largest integrated utility companies in the U.S., with roughly 5.5 million customers covering 11 states.

For Q3 2021, American Electric Power reported a 12.2% year-over-year increase in revenue to $4.6 billion, surpassing the consensus estimate of $4.36 billion. It posted EPS of $1.43, falling short of the consensus estimate of $1.46.

The company recently distributed a quarterly dividend of $0.78 per share. American Electric Power stock currently offers a dividend yield of 3.3%, compared to the sector average of 2.9%. American Electric Power’s stock has gained about 15.87% over the past year.

With this in mind, we used TipRanks to take a look at the risk factors for American Electric Power.

Risk Factors

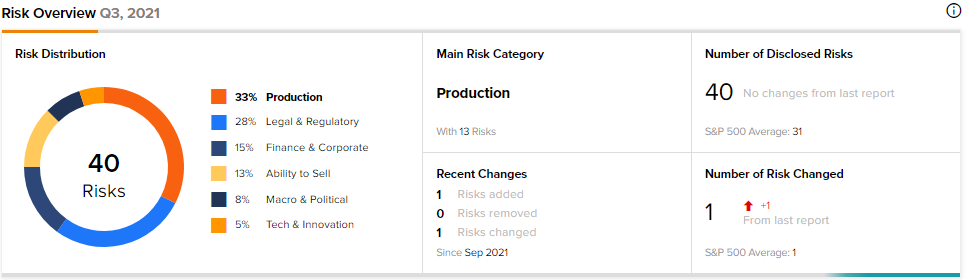

According to the new TipRanks Risk Factors tool, American Electric Power’s main risk category is Production, representing 33% of the 40 total risks identified for the stock. Legal & Regulatory and Finance & Corporate are the next two major risk categories at 28% and 15%, respectively. American Electric Power recently updated its profile with one new risk factor under the Legal & Regulatory category.

American Electric Power informs its investors that it is subject to complex tax regulations. It cautions that even though the company complies with the current taxation policy, the recent presidential and congressional elections in the U.S. could bring noteworthy changes to the tax laws and regulations. The company mentions that any unfavorable development could have a negative effect on financial conditions and results of operations.

Under the Production risk category, AEP updated investors about the “Employment/Personnel” risk. It mentions that events like aging human resources, non-compliance with COVID-19 protocols, skills mismatch, and unavailability of requisite employees may lead to higher costs and operating challenges. Such failure will adversely impact the business and its functions may be disrupted.

The Production risk factor’s sector average is 25%, below American Electric Power’s 33%.

Analysts’ Take

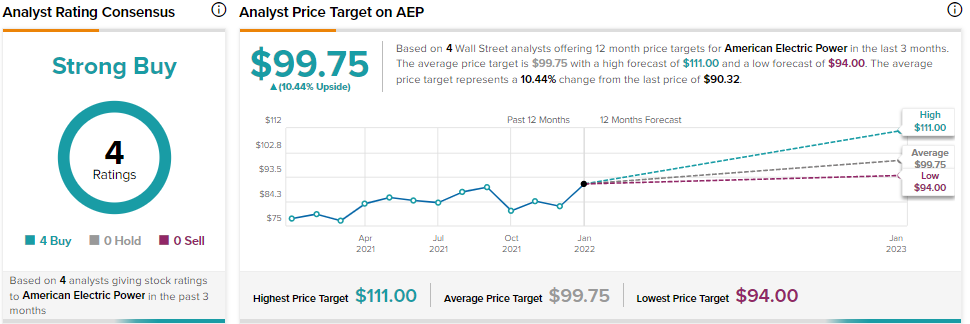

Mizuho Securities analyst Paul Fremont recently reiterated a Buy rating on American Electric Power stock with a price target of $94, which suggests 4.07% upside potential.

Despite the risks to AEP, consensus among analysts is a Strong Buy, based on 4 Buys. The average American Electric Power price target of $99.75 implies 10.44% upside potential to current levels.

Download the TipRanks mobile app now

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Read full Disclaimer & Disclosure

Related News:

Inside CMS Energy’s Risk Factors

Xerox Opts Oracle’s Cloud to Launch New Businesses

Apple + Roblox? Ross Berger Has More Advice for Tim Cook