T-Mobile US (TMUS), an S&P 500 company, is a wireless network operator that provides phone services to consumers and wholesale customers. The company is majority-owned by German telecom giant Deutsche Telekom (DTEGY).

For Q4 2021, T-Mobile reported a 2.2% year-over-year jump in revenue to $20.8 billion, falling short of the consensus estimate of $21.1 billion. It posted EPS of $0.34, which declined from $0.60 in the same quarter the previous year but still beat the consensus estimate of $0.18.

With this in mind, we used TipRanks to take a look at the newly added risk factors for T-Mobile.

Risk Factors

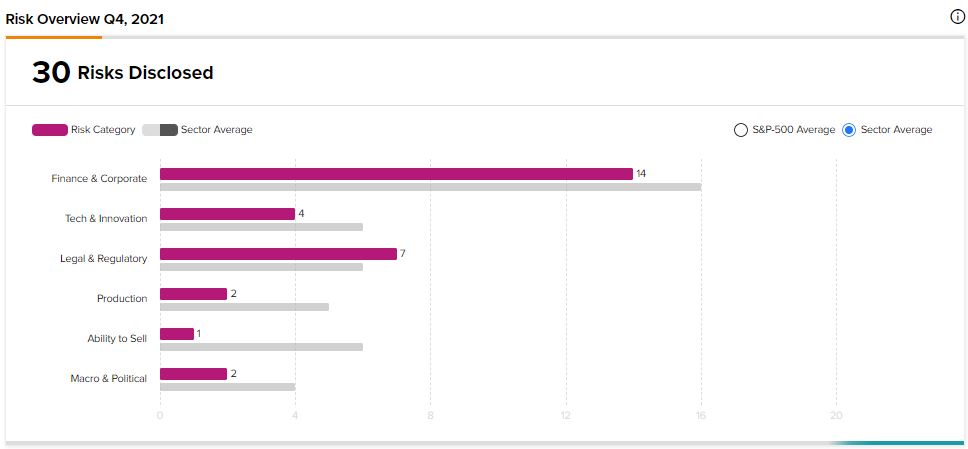

According to the new TipRanks Risk Factors tool, T-Mobile’s main risk category is Finance and Corporate, which contains 14 of the total 30 risks identified for the stock. Legal and Regulatory and Tech and Innovation are the next two major risk categories with 7 and 4 risks, respectively. T-Mobile has recently added two new risk factors under the Finance and Corporate category and updated several previously highlighted risks.

T-Mobile tells investors in a newly added risk factor that its revised certificate of incorporation designates a specific court in Delaware as the exclusive forum for settling certain lawsuits against the company. The company explains that its selection of the court may discourage shareholders from suing it. However, T-Mobile cautions that it may incur excess costs, and its business and financial condition may be harmed if it were forced to settle lawsuits outside its preferred courts.

In another newly added risk factor, T-Mobile informs investors that changes in credit market conditions could make it difficult to raise debt favorably. It explains that inflation, general economic conditions, and regulatory measures such as interest rate adjustments could cause volatility in credit and equity markets. As a result, borrowing may become more expensive and the company may be unable to obtain financing on acceptable terms.

T-Mobile has updated the risk factor that discusses challenges tied to its merger with Sprint. It says that it has been operating multiple billing systems since closing the merger. However, its long-term goal is to bring Sprint’s legacy customers onto its own billing platforms. The company cautions that the consolidation of the billing systems could run into various problems, resulting in delays that could adversely affect its operations, reputation, and financial condition.

T-Mobile’s stock has gained about 9% year-to-date.

Analysts’ Take

RBC Capital analyst Kutgun Maral recently maintained a Buy rating on T-Mobile stock but lowered the price target to $152 from $180. Maral’s reduced price target still suggests 22.11% upside potential. The analyst observed that T-Mobile’s Q4 revenue missed the consensus expectation but noted that the company’s management has a long track record of strong execution.

Consensus among analysts is a Strong Buy based on 11 Buys and 1 Hold. The average T-Mobile price target of $158.58 implies 27.39% upside potential to current levels.

Download the TipRanks mobile app now.

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Read full Disclaimer & Disclosure

Related News:

Will ConocoPhillips Restructure its Asset Base Further?

Pfizer Bags Conditional Approval for COVID-19 Drug Paxlovid in China

Senseonics Receives FDA Approval for Glucose Monitoring System