Neurocrine (NBIX) is an American biopharmaceutical company based in California. It develops treatments for endocrine and neuropsychiatric disorders. It already has several FDA-approved treatments, some developed in partnership with AbbVie (ABBV).

The company has continued to seek strategic partnerships as it expands its product portfolio. For example, Neurocrine recently agreed to collaborate with Sosei Heptares on a program to develop treatments for diseases such as schizophrenia and dementia.

Neurocrine’s earnings report shows revenue rose to $296 million in Q3 2021 from $258.5 million in the same quarter last year but slightly missed the consensus estimate of $296.7 million. The company posted adjusted EPS of $0.64, beating the consensus estimate of $0.59.

Neurocrine ended Q3 with $1.3 billion in cash. In 2022, the company plans to invest in expanding its commercial footprint and seek FDA approval for valbenazine, its drug candidate for the treatment of chorea associated with Huntington’s disease in adults.

With this in mind, we used TipRanks to take a look at the newly added risk factors for Neurocrine.

Risk Factors

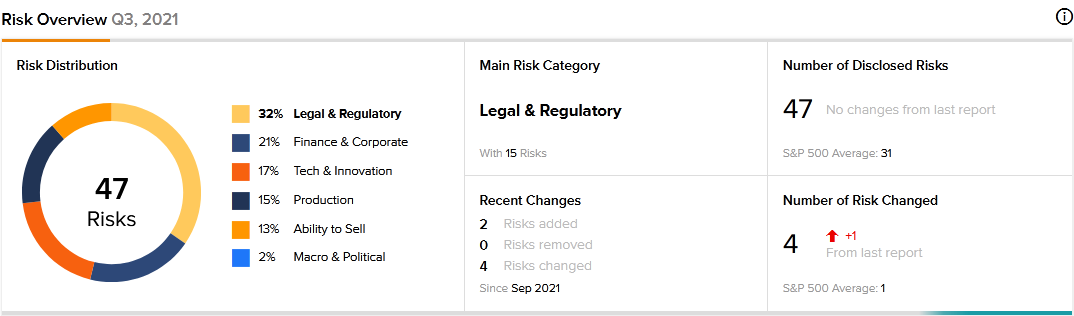

According to the new TipRanks Risk Factors tool, Neurocrine’s main risk category is Legal and Regulatory, representing 32% of the total 47 risks identified for the stock. Finance and Corporate and Tech and Innovation are the next two major risk categories at 21% and 17% of total risks, respectively. Neurocrine has recently updated its profile with two new risk factors.

The company informs investors that its 2024 notes carry a conditional conversion feature. If the feature is triggered, Neurocrine says it would be required to meet its conversion obligations by paying the noteholders with cash. Therefore, it cautions that the conditional conversion feature of the 2024 notes may adversely affect its operating results and liquidity.

Neurocrine tells investors that it may be subject to disputes and lawsuits relating to labor, tax, product safety, intellectual property, and marketing practices. For example, the company mentions that it is currently engaged in intellectual property lawsuits related to its INGREZZA product. It cautions that disputes and lawsuits may divert management’s attention and cause it to incur significant expenses.

The Legal and Regulatory risk factor’s sector average is 20%, compared to Neurocrine’s 32%. Neurocrine’s stock has declined about 11% over the past year.

Analysts’ Take

Leerink Partners analyst Marc Goodman recently reiterated a Hold rating on Neurocrine stock with a price target of $100, which suggests 15.35% upside potential.

Consensus among analysts is a Moderate Buy based on 12 Buys, 5 Holds, and 1 Sell. The average Neurocrine price target of $119.87 implies 38.27% upside potential to current levels.

Download the mobile app now, available on iOS and Android.

Related News:

Volex Closes Acquisition of Two Wire Harness Makers

GDI Integrated Facility Services Buys IH Services

Algonquin Closes Acquisition of New York American Water