California-based HP (HPQ) provides personal computing, printing, and related products and services. It recently acquired a startup called Teradici to enhance its solutions to the hybrid-work environment.

With this in mind, we used TipRanks to take a look at the latest financial performance and newly added risk factors for HP. (See Top Smart Score Stocks on TipRanks)

Q4 Financial Results

HP reported revenue of $16.7 billion for the fourth quarter of Fiscal 2021 ended October 31, exceeding the consensus estimate of $15.4 billion. Revenue was $15.3 billion in the same quarter last year. It posted adjusted EPS of $0.94 versus $0.62 in the same quarter last year and beat the consensus estimate of $0.88.

HP distributed $219 million in dividends and repurchased $1.8 billion of shares during Q4. It ended the quarter with $4.3 billion in cash. (See HP stock charts on TipRanks).

Risk Factors

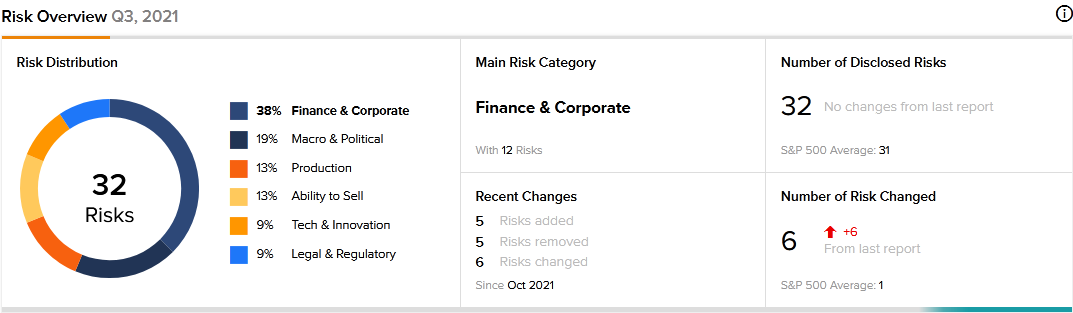

According to the new TipRanks Risk Factors tool, HP’s main risk category is Finance and Corporate, representing 38% of the total 32 risks identified for the stock. The company recently updated its profile with five new risk factors.

HP cautions investors that its share repurchase program may be suspended or canceled at any time. Moreover, changes in tax laws, cash flow, and stock price may affect the timing of the repurchases. Although the share repurchase program is intended to enhance long-term shareholder value, HP cautions that this may not be achieved.

In addition to Teradici, HP has also recently acquired HyperX to strengthen its gaming products business. It may make more acquisitions in the future. Although acquisitions are part of its business strategy, HP cautions investors that it may not achieve the anticipated benefits of the acquisitions. In addition to acquiring other businesses, HP may also divest businesses that no longer align with its objectives. However, it cautions that finding buyers for the businesses may be difficult, and it may end up selling them at less desirable prices.

HP tells investors that it has been experiencing component shortages and that the problem may continue during 2022. It cautions that component shortages could increase its costs and hinder its ability to meet the demand for its products. HP further informs investors that it relies on contract manufacturers to produce many of its products, and cautions that these manufacturers may decide to end their business agreements. If that happens, HP warns that the relationships with its customers may be damaged, and its sales and profitability may decrease.

The company informs investors that climate change may have a long-term impact on its business. It mentions that extreme weather events may damage the critical infrastructure that its business relies on and disrupt its operations. HP also cautions that failure to meet its climate goals could damage its reputation.

The Finance and Corporate risk factor’s sector average is 40%, compared to HP’s 38%. HP’s stock has gained about 48% year-to-date.

Analysts’ Take

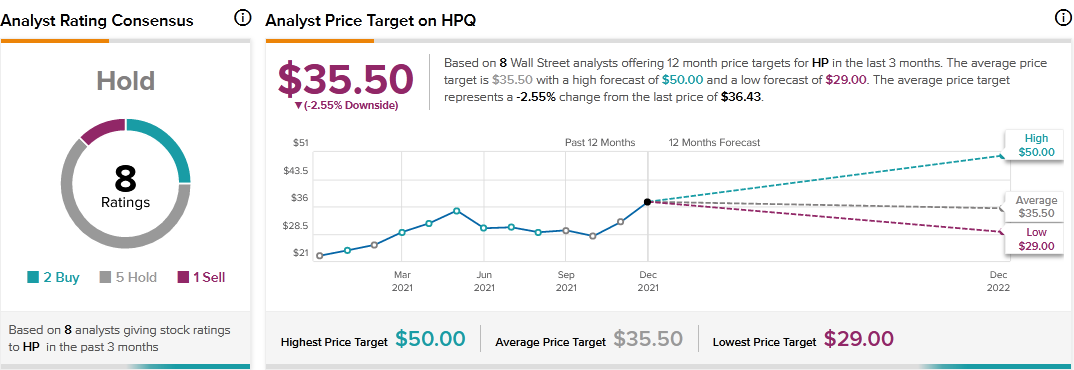

Following HP’s Q4 earnings report, Wells Fargo analyst Aaron Rakers reiterated a Hold rating on HPQ stock and raised the price target to $35 from $30. Rakers’ new price target suggests 3.93% downside potential.

Consensus among analysts is a Hold based on 2 Buys, 5 Holds, and 1 Sell. The average HP price target of $35.50 implies 2.55% downside potential from current levels.

Related News:

Kraft Heinz Inks Deal to Buy Just Spices; Shares Gain

CIBC Miracle Day Raises C$6M for Children’s Charities

Laurentian Bank Posts Loss in Q4, Dividend Raised