Horizon Therapeutics (HZNP) develops medicines for treating rare diseases. It has several products on the market and multiple drug candidates under development. Let’s take a look at Horizon’s latest financial performance and risk factors.

Horizon Therapeutics’ Q2 Financial Results and 2021 Guidance

The company reported second-quarter revenue of $832.5 million, which increased 80% year-over-year and exceeded the consensus estimate of $685 million.

Revenue growth was attributed to the strong performance of its TEPEZZA and KRYSTEXXA drugs, whose sales jumped 173% and 73% year-over-year, respectively. Adjusted EPS rose to $1.62 from $0.40 a year ago and beat consensus estimates of $0.88. (See Horizon Therapeutics stock charts on TipRanks).

Horizon said that the supply of TEPEZZA was disrupted for several months because of COVID-19 vaccine orders, but the supply of the drug resumed in April, and demand has remained strong.

Following the strong Q2 results, Horizon Therapeutics boosted its expectations for full-year 2021. It now anticipates revenue to come in between $3.03 billion and $3.13 billion. Previous guidance was for revenue of between $2.75 billion and $2.85 billion.

Horizon Therapeutics’ Risk Factors

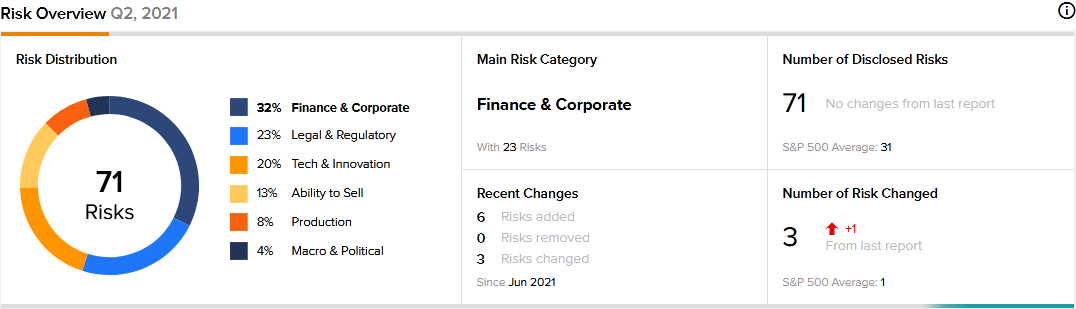

The new TipRanks Risk Factors tool shows 71 risk factors for Horizon Therapeutics. Since June 2021, the company has amended its risk profile to introduce six new risk factors.

A newly added risk factor tells investors that some of Horizon’s drugs and drug candidates are based on intellectual property rights obtained through government-funded programs. Therefore, such products may be subject to manufacturing restrictions and limited exclusive rights.

Another newly added risk factor cautions investors about the potential of early competition for some Horizon drugs. The company states that its biological products may not enjoy the 12-year market exclusivity due to FDA decisions or congressional action.

Furthermore, the company tells investors that some of its drug candidates target small patient populations. Therefore, it cautions that sales of those drugs may not be profitable unless they are approved for other indications.

Finance and Corporate is Horizon Therapeutics’ largest risk category at 32% of its total risks. That is above the sector average of 30%. Horizon’s shares have gained about 43% since the beginning of 2021.

Analysts’ Take

Following Horizon Therapeutics’ Q2 report and citing the resumption of TEPEZZA supply, Stifel Nicolaus analyst Annabel Samimy reiterated a Buy rating on HZNP stock and raised the price target to $130 from $125. The analyst’s new price target suggests 24.35% upside potential.

“With commercial efforts on solid ground, we turn to the increasing pipeline activity…While HZNP shares are at an all-time high, we think its next growth chapters are underappreciated,” commented Samimy.

Consensus among analysts is a Strong Buy based on 7 Buys. The average Horizon Therapeutics price target of $134.14 implies 28.31% upside potential to current levels.

Related News:

Wix Delivers Q2 Results; Shares Drop 17%

Amwell Reports Mixed Q2 Results; Shares Fall 2.7%

Wendy’s Q2 Results Top Estimates, Raises Guidance