Cintas Corp. (CTAS) provides corporate identity uniforms, restroom supplies, first aid, safety products, and associated services across the globe. Its segments include Uniform Rental and Facility Services, and First Aid and Safety Services. Recently, Cintas posted better-than-expected Q4 results.

Let’s take a look at the company’s financial performance and what has changed in its key risk factors that investors should know.

On the back of 13.7% organic revenue growth in the Uniform Rental and Facility Services segment, Cintas’ Q4 revenue increased 13.3% year-over-year to $1.84 billion, beating analysts’ estimate of $1.82 billion.

Cintas’ President and CEO Todd M. Schneider said, “Our prospects for continued growth are great. Our value proposition is strong, and we have a vast total addressable market. Also, our continued investment in technology is a competitive advantage.”

Its gross margin expanded by 310 basis points over the previous year to 46.8%, which, in turn, helped earnings per share jump 83% year-over-year to $2.47, ahead of the Street’s estimate of $2.30. (See Cintas stock chart on TipRanks)

Looking ahead to Fiscal Year 2022, the company estimates revenue to be in the range of $7.53 billion to $7.63 billion and earnings per share to be in the range of $10.35 to $10.75.

Furthermore, Cintas also raised its quarterly dividend by 26.7% to $0.95 per share. The dividend is payable on September 15 to stockholders of record as of August 13. The company has also announced a $1.5 billion share buyback program. The number of shares to be purchased and timing will remain at the discretion of its Board.

Todd M. Schneider said, “Given our excellent financial results and strong financial position, we are pleased to announce an increase in the quarterly dividend. The dividend, accompanied by our share buyback program, continues to demonstrate our commitment to increasing shareholder value.”

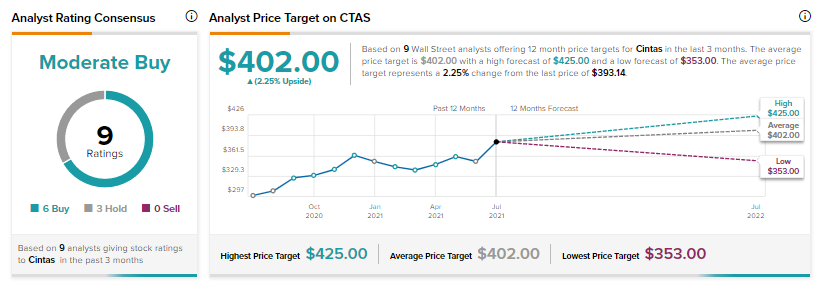

Following Cintas’ Q4 performance, Argus Research analyst John Eade reiterated a Buy rating on the stock, while increasing the price target to $410 from $390. Eade noted that while Cintas’ revenue growth has slowed, it is improving bottom line through an expansion in margins.

Based on 6 Buys and 3 Holds, consensus on the Street is a Moderate Buy. The average Cintas price target of $402 implies the stock is fairly priced at current levels. Shares have gained 14.4% so far this year.

Now, let’s look at what has changed in the company’s key risk factors.

According to the new Tipranks’ Risk Factors tool, Cintas’ two main risk categories are Finance & Corporate and Legal & Regulatory, which account for 28% and 22%, respectively, of the total 18 risks identified. Since May, the company has changed one key risk factor.

Under the Production category, the company highlights that its entire operation depends upon attracting, developing, and retaining key employees. Factors such as competitive pressures, reduced employee engagement, and higher employee turnover could negatively affect Cintas’ relationships with its employees, which could also affect its financial condition and results.

The Finance & Corporate risk factor’s sector average is at 45%, compared to Cintas’ 28%.

Related News:

T. Rowe Shares Slip 1.4% Despite Impressive Q2 Results

Danimer Acquisition Environmentally-Friendly

Capital One Bumps Up Quarterly Dividend By 50%