1Life Healthcare (ONEM), also called One Medical, provides membership-based primary healthcare. It operates a chain of clinics and also serves members online.

Let’s take a look at the company’s latest financial performance, corporate developments, and changes in risk factors. (See 1Life Healthcare stock charts on TipRanks).

1Life Healthcare’s Q2 Financial Results and 2021 Outlook

Revenue increased 54% year-over-year to $120.4 million in Q2 2021, exceeding the consensus estimate of $115.67 million. The company made a loss per share of $0.30, compared to the loss per share of $0.24 in the same quarter last year and the consensus-estimated loss per share of $0.20. One Medical’s membership count grew 31% year-over-year to 621,000 in Q2. The company ended the quarter with $653.8 million in cash.

For Q3, 1Life Healthcare anticipates revenue in the range of $140 million to $148 million. It expects to end the quarter with between 691,000 and 697,000 members.

For full-year 2021, the company anticipates revenue in the band of $586 million to $599 million. It expects to end the year with 717,000 to 723,000 members.

1Life Healthcare’s Corporate Developments

In June 2021, 1Life Healthcare agreed to acquire Iora Health for $2.1 billion in stock. The transaction closed on September 1, and One Medical updated its revenue and membership outlook for both Q3 and full-year 2021.

Iora Health is a primary care group that serves Medicare members. One Medical counts on the acquisition to extend its reach beyond children and adults to include seniors. It will now be able to reach about 40% of the U.S. population and target a market worth $870 billion.

1Life Healthcare’s Risk Factors

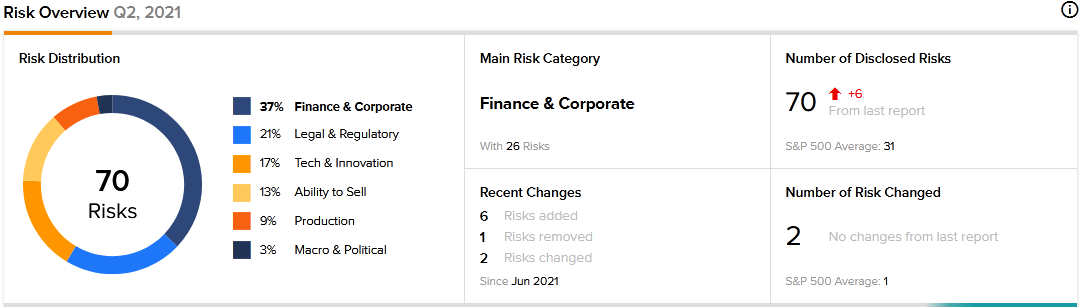

The new TipRanks Risk Factors tool shows 70 risk factors for 1Life Healthcare. Since Q4 2020, the company has updated its risk profile to add six new risk factors and remove one.

In a newly added risk factor, One Medical tells investors that it may face difficulties integrating Iora Health into its operations. Therefore, it cautions that the integration may not be as successful as expected, and it may not achieve the anticipated benefits of the merger.

One Medical says that the healthcare solutions market is highly competitive. Therefore, it cautions that if it is unable to compete effectively, even after acquiring Iora Health, its operations and finances may be adversely impacted. It added that such an impact may lead to lowering the prices of its services to defend its market share.

The company removed the risk factor that warned about the potential adverse effects of settling convertible debt securities. It previously said that its financial results could be affected by the accounting methods applied to convertible debts settled in cash.

The majority of 1Life Healthcare’s risk factors fall under the Finance and Corporate category, with 37% of the total risks. That is above the sector average of 29%. 1Life Healthcare’s stock price has dropped about 46% year-to-date.

Analysts’ Take on 1Life Healthcare

Credit Suisse analyst Jailendra Singh recently reiterated a Buy rating on 1Life Healthcare stock but lowered the price target to $39 from $50. Singh’s new price target suggests 64.49% upside potential.

Consensus among analysts is a Strong Buy based on 9 Buys and 2 Holds. The average 1Life Healthcare price target of $39.39 implies 66.13% upside potential to current levels.

Related News:

Johnson Controls Issues $500M Sustainability-Linked Bond

What Does Cimpress’ Newly Added Risk Factor Tell Investors?

What do the Changes in Fastly’s Risk Factors Reveal?