In anticipation of the high demand expected from the U.S. government’s initiatives to upgrade the country’s ailing infrastructure, Nucor Corporation (NYSE: NUE) has agreed to purchase Summit Utility Structures LLC and Sovereign Steel Manufacturing LLC for an undisclosed amount.

The news seems to have lifted market sentiments for this $35.6-billion company. Its stock rose 3.4% on Tuesday to close at $133.78.

Rationale Behind the Deal

Summit Utility Structures has expertise in manufacturing tubular poles, including transmission poles for high-voltage power, lighting poles for sports and other purposes, distribution poles, and wireless poles. It serves customers in the transportation, utility, communications, and lighting industries.

Meanwhile, Sovereign Steel Manufacturing has solid experience in making simple bridge structures, highway signs, and substation and transmission structures (including lattice towers and poles). It caters to the needs of the utility, transportation, and lighting industries.

Nucor will be housing the acquired companies under a new unit, Nucor Towers & Structures. This business unit will focus on serving the telecommunication, utility, and transportation industries. Nucor anticipates expanding the footprint of these companies throughout North America.

The company believes that the demand for infrastructural products will get a boost from upgrades expected in the transportation industry as well as from the higher use of wireless data and the growing adoption of 5G in the telecommunication industry.

Also, a trend toward renewable energy, the need for reliable energy storage, utility grid upgrades, and a growing population will strengthen demand from the utility industry.

Official Comments

The President and CEO of Nucor, Leon Topalian, opines that the buyouts will fortify Nucor’s position “as the leader in steel and downstream steel products.”

“We intend to grow these businesses to become the preferred solutions provider for utility transmission towers, substations, telecommunication towers and highway signage structures,” Topalian said.

Meanwhile, Nucor’s Executive Vice-President of New Markets and Innovation, Chad Utermark, said, “The creation of Nucor Towers & Structures strongly complements our plate capabilities while also adding a new dimension to our arsenal of value-added downstream products …”

Stock Rating

On TipRanks, the stock has a Hold consensus rating based on two Buys and six Holds. Nucor’s average price forecast of $152.57 suggests 14.05% upside from current levels.

Last week, Emily Chieng of Goldman Sachs maintained a Hold rating on Nucor while lowering the price target to $130 (2.83% downside potential) from $148.

Chieng is cautious about Nucor despite its healthy price performance, up 21.6%, in the past year.

Crowd Wisdom

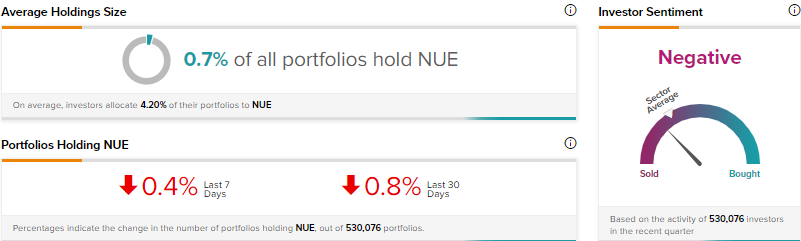

As per the TipRanks, investor sentiment is currently Negative for NUE, as 0.8% of portfolios tracked by TipRanks decreased their exposure to the stock in the last 30 days.

Conclusion

Nucor’s constant search for partners is expected to help it penetrate deeper into markets served and expand geographically. One of its notable buyouts has been C.H.I. Overhead Doors for $3 billion in May 2022.

Also, such buyout activities and other efforts to boost organic growth opportunities might help improve the investment appeal of the stock.

Read full Disclosure