Petrochemicals, polymers and fabricated building products manufacturer and supplier Westlake Chemical Corporation (WLK) recently revealed that it has entered into a definitive agreement to acquire Hexion Inc.’s global epoxy business for $1.2 billion. The deal is likely to close in the first half of 2022.

Following the news, shares of the company gained 2.7% to close at $102.40 on Wednesday.

Implications of the Deal

With significant expertise in the manufacturing and development of specialty resins, coatings and composites for a variety of industries, the addition of Hexion’s epoxy business will allow Westlake to significantly expand its integrated business by adding a downstream portfolio of coatings and composite products to its chloro-vinyls businesses.

Notably, in the past 12 months, ended September 30, 2021, Hexion’s epoxy business has generated net sales of roughly $1.5 billion.

Management Commentary

The CEO of Westlake, Albert Chao, said, “The industries served by Hexion Epoxy are very attractive to Westlake and the business is expected to be a synergistic addition to Westlake’s existing businesses. We look forward to welcoming the Hexion epoxy employees to the Westlake family and realizing the tremendous opportunities to grow the combined businesses.”

See Insiders’ Hot Stocks on TipRanks >>

Price Target

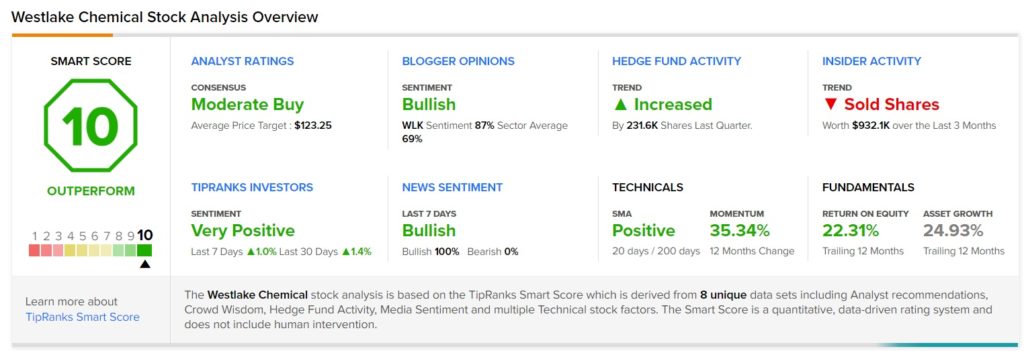

Recently, Goldman Sachs analyst Robert Koort reiterated a Hold rating on the stock. The analyst, however, raised the price target from $111 to $123, which implies upside potential of 20.1% from current levels.

The Wall Street community is cautiously optimistic about the stock and has a Moderate Buy consensus rating based on 5 Buys and 4 Holds. The average Westlake price target of $123.25 implies that the stock has upside potential of 20.4% from current levels.

Smart Score

Westlake scores a “Perfect 10” from TipRanks’ Smart Score rating system, indicating that the stock is likely to outperform market expectations. Shares have gained 31.6% over the past year.

Related News:

Apple Files Lawsuit Against Spyware Firm NSO Group

Dollar Tree Tops Q3 Results; Shares Up 9%

Verizon Acquires TracFone Wireless