Global payment services providers Western Union (WU) and Moneygram International (MGI) resumed money-transfer services to Afghanistan on September 2, according to a report published by Reuters. The companies suspended services in Afghanistan over a fortnight ago after the Taliban captured Kabul.

Headquartered in Colorado, Western Union offers its services to all the countries across the world, excluding North Korea and Iran. It has a network of more than 500,000 agent locations. Meanwhile, Texas-based Moneygram provides bill payment solutions, along with money transfer and money order services.

The President of Western Union’s Asia, Europe, the Middle East and Africa regions, Jean Claude Farah, said, “The reopening of banks, plus a push by the U.S. to facilitate humanitarian assistance to the Afghan people, had given the American company confidence to resume services on Thursday.”

“We are continuing to engage with the U.S. government and others to understand their policies and what type of longer-term regulatory framework will be put in place as it relates to the Taliban,” Farah added. (See MoneyGram stock chart on TipRanks)

Western Union said that payouts of any funds sent to the South Asian nation were available only at a few locations, while outbound services remained suspended. (See Western Union stock chart on TipRanks)

Last month, Morgan Stanley analyst James Faucette reiterated a Sell rating on Western Union with a price target of $21 (3.1% downside potential).

The analyst said, “WU’s transaction growth is holding up modestly better than we expected, likely for two reasons: 1) digital growth isn’t cannibalizing traditional retail transactions as quickly as we anticipated, and 2) COVID-19 case flare-ups and related challenges in emerging markets that are key receiver destinations for WU are causing elevated levels of remittance spend to persist.”

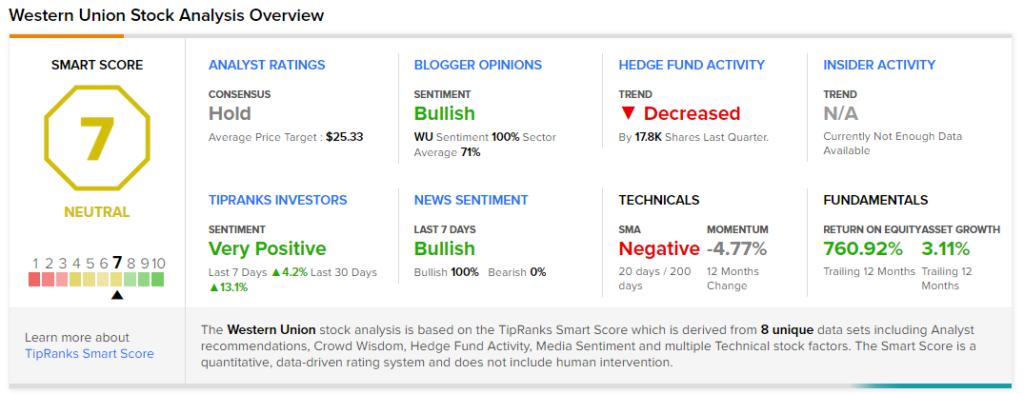

Overall, the stock has a Hold consensus rating based on 1 Buy, 3 Holds and 2 Sells. The average Western Union price target of $25.33 implies 16.9% upside potential. The company’s shares have lost 9.2% over the past six months.

According to TipRanks’ Smart Score rating system, Western Union scores a 7 out of 10, suggesting that the stock is likely to perform in line with market averages.

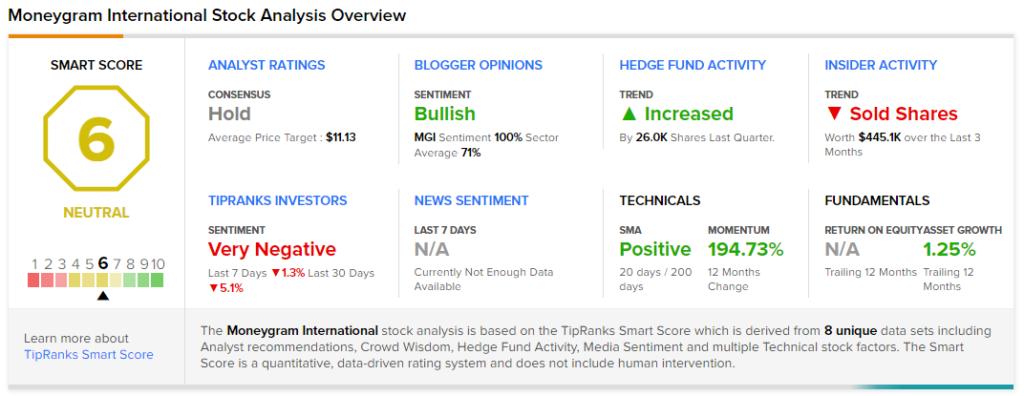

Meanwhile, Moneygram has a Hold consensus rating based on 1 Buy and 1 Sell. The average Moneygram International price target of $11.13 implies 24.8% upside potential. The company’s shares have gained 199.3% over the past year.

According to TipRanks’ Smart Score rating system, Moneygram scores a 6 out of 10, suggesting that the stock is likely to perform in line with market averages.

Related News:

Nikola Strikes Fuel-Cell Manufacturing Deal with Bosch Group

Verizon Announces Hike in Quarterly Dividend

Broadcom Posts Q3 Beat and Provides Q4 Revenue Guidance