Weibo (WB) is slated to release its second-quarter earnings results on September 1, before the market opens. Weibo has consistently outperformed the Street’s expectations, reporting higher-than-expected earnings-per-share (EPS) figures in the last eight consecutive quarters. However, website traffic trends are currently negative for the company.

For Q2, analysts expect Weibo to post earnings of $0.43 per share. This is much lower than reported earnings of $0.79 per share in the year-ago quarter. Meanwhile, revenues are pegged at $446.88 million, also lower than the previous quarter’s tally of $473.98 million.

On June 1, Weibo reported upbeat Q1 results topping both earnings and revenue expectations.

Commenting on the beat despite disruptions from the COVID-19 resurgence in China, Weibo CEO Gaofei Wang stated, “Our user base and traffic continued to grow nicely with disciplined marketing spending, which demonstrated our core value in public conversation and enriched content ecosystem.”

Headquartered in Beijing, China, Weibo Corporation trades on the Nasdaq exchange under the symbol “WB.” It is a Chinese social media platform that allows people to create, distribute, and discover content in China. It operates through the Advertising and Marketing Services and Other Services segments.

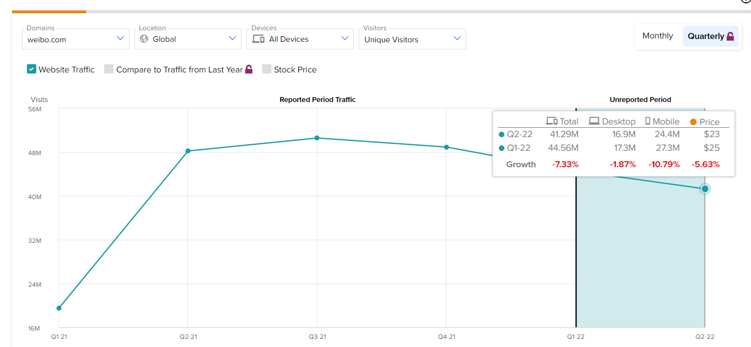

Weibo’s Declining Website Traffic Raises Concerns

As per TipRanks’ Website Traffic Tool, the momentum in Weibo’s business shows a declining trend. According to the tool, the number of visits to weibo.com declined 7.33% quarter-over-quarter in Q2. Further, the footfall on the company’s website has declined 14.4% year-over-year.

The decline in website visits hints at a slowdown in revenues and monthly active users, which could have some impact on the company’s second-quarter revenues. Learn how Website Traffic can help you research your favorite stocks.

Is WB a Good Stock to Buy?

On TipRanks, Weibo has a Moderate Buy consensus rating based on three Buys, two Holds and one Sell. Weibo’s average price forecast of $31.62 implies 62.2% upside potential.

Interestingly, hedge funds have a Very Positive outlook regarding WB stock. They collectively increased their WB holdings by 177,400 shares in the last quarter.

Conclusion: Investors Await Weibo’s Earnings

Weibo stock has lost over half of its market capitalization over the past year. However, the stock has somewhat stabilized in the past month. WB’s second-quarter results will help the stock pick a direction in the short term, but website traffic trends don’t look encouraging.