U.S. stocks experienced higher volatility this past week and the broader market averages fell about 3%. Energy and Materials names led the way lower. The Dow Jones Industrial Average and S&P 500 ended January in negative territory.

Increased speculation in Gamestop (GME) and other names with high short interest created wild swings.

The Dow Jones Industrial Average experienced two daily declines of more than 600 points this week. This serves as a reminder of the importance of portfolio diversification.

Mot every investment will pan out in the short- or long-term as originally planned. By identifying stocks with positive characteristics – one measure we highlight below is the Smart Score – diversifying a portfolio across several quality holdings can provide insurance against unexpected investment pitfalls.

Earnings/Economic Update

Market volatility overshadowed Earnings Season, even though 24% of companies in the S&P 500 posted quarterly results. 84% of the names surpassed expectations this quarter, ahead of the average of 76% over the previous four quarters.

In economic news, we received the initial reading of fourth-quarter GDP on Thursday. The U.S. economy grew 4% in the final three months of 2020; which was a return to a more normalized pace of expansion, following two quarters of 30%-plus swings in opposite directions.

Coronavirus News

While it may no longer be the top news story in the financial press, the coronavirus pandemic is still with us.

Both Novavax (NVAX) and Johnson & Johnson (JNJ) posted solid data about their potential vaccines this week. On Thursday, Novavax said that preliminary Phase 3 figures showed its vaccine was 89% effective in a study of 15,000 volunteers in the U.K. The following day, Johnson & Johnson reported that its single-dose vaccine was 72% effective in the U.S., in a Phase 3 trial with 19,000 volunteers.

Neither vaccine fared as well in trials in South Africa, where a new variant of COVID-19 has been detected. Moderna (MRNA) and Pfizer (PFE), whose vaccines are in use in the U.S., said they are working on a third “booster” shot to combat mutations.

What to Expect Next Week

112 companies in the S&P 500 will post results next week. These notable names will report on Tuesday: Alphabet (GOOG), Amazon (AMZN), Exxon Mobil (XOM), and Pfizer.

On the economic front, we’ll receive the January jobs data on Friday. Expectations call for the addition of 50,000 non-farm payrolls and for the headline unemployment rate to remain at 6.7%.

Following the snap-back recovery in stocks last year from Pandemic lows, we believe that investment gains will be harder to come by in 2021. As a result, deciding what and when to buy can be challenging for any investor. However, the fact remains that attractive investments are out there if you’re willing to dig a little deeper.

One such Consumer name is worth a closer look and is our Stock of the Week.

Stock of the Week: Reynolds Consumer Products (REYN)

The company makes items that are used in and around the kitchen, under the Reynolds, Hefty and Presto brands.

The stock gained 1.6% this week and we believe this momentum can continue in the first half of 2021. Here’s why:

One trend that has emerged during the coronavirus pandemic, is that people are eating more meals at home. Whether it’s to save money, or because travel activity is restricted, this has led to higher demand for Reynolds’ products.

Back on Jan. 4, RBC Capital upgraded the stock from Sector Perform to Outperform. Analyst Nik Modi set a Street-high price target of $35 (16.7% upside potential).

Modi is rated in the top-4% of the more than 7,200 analysts tracked by TipRanks, adding weight to the call.

Reynolds’ brands are well-known to consumers, however, the business only went public a year ago, and we don’t believe the shares are getting the attention they deserve.

The company is trading at 15x expected 2021 earnings of $2.01 a share. This represents a discount to both the broader market and median industry valuation of 22.6x.

In the meantime, Reynolds pays a quarterly dividend of $0.22 a share (2.9% yield). This payout is attractive in a low interest-rate environment and offers a cushion if markets remain volatile in the near term.

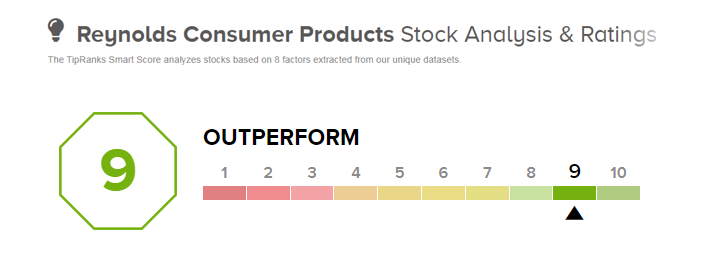

Finally, the company carries a Smart Score of 9/10 on TipRanks. This proprietary score utilizes Big Data to rank stocks based on 8 key factors that have historically been a precursor of future outperformance.

On top of the positive aspects mentioned already, the Smart Score indicates that shares have seen insider buying and improving sentiment from financial bloggers.

FYI: This is just 1 of the 20+ stocks selected for the Smart Investor portfolio. That’s where we share more detailed insights on our weekly stock picks.