Higher yields on long-term U.S. Treasury bonds spooked investors this week, sending the S&P 500 down 2.5%. Utility and Consumer Discretionary stocks led the way lower, while the Energy sector rallied.

The yield on the benchmark 10-year note moved up to 1.46% this week. At one point it eclipsed the estimated dividend yield of the S&P 500.

On one hand, rates are rising because the U.S. economy is gradually reopening following pandemic-related shutdowns. On the other, there is growing concern that a low interest-rate policy from the Federal Reserve and trillions of dollars of government stimulus could cause future inflation to run white-hot.

Rising interest rates directly benefit few companies outside of the financial sector. Higher rates have a negative effect on asset prices. However, investors can mitigate this by focusing on names with consistent growth and stay disciplined about valuation.

Policy Update

In two days of testimony with the Senate Banking Committee, Fed Chair Jerome Powell doubled-down on his pledge to keep interest rates low on the short end of the curve. The Federal Reserve is more focused on supporting a recovery in the U.S. jobs market, than concern about potential inflation fears.

To that end, it was reported on Friday that the PCE deflator grew just 1.5% in January, excluding food and energy. This is the Fed’s key measure of consumer inflation. Historically, they have not raised rates unless it grows more than 2%.

On the fiscal side, the U.S. House of Representatives passed President Biden’s $1.9 trillion economic stimulus bill early Saturday. The plan will next be debated in the Senate and includes $1,400 of direct payments for qualified individuals.

Vaccine Approval

On Saturday, Johnson & Johnson received emergency use approval from the Food and Drug Administration (FDA), for its COVID-19 vaccine. This is the third vaccine cleared for use in the U.S. and the first designed to be administered in one dose.

Over 70 million COVID-19 vaccine shots have been administered in the U.S. It is currently on pace to achieve 200 million doses by Memorial Day. Adding a third (and single-shot) vaccine will likely push those targets forward, allowing for more parts of the U.S. economy to re-open in the coming months.

What to Expect Next Week

Broadcom (AVGO) and Target (TGT) headline a relatively light earnings calendar next week. On the economic front, we’ll get the February jobs report on Friday. Consensus expectations call for the addition of 200,000 non-farm payrolls for the month and the headline unemployment rate to tick down to 6.3%.

Following the snap-back recovery in stocks last year from Pandemic lows, we believe that investment gains will be harder to come by in 2021.

As a result, deciding what and when to buy can be challenging for any investor.

However, the fact remains that attractive investments are out there, if you’re willing to dig a little deeper.

One such Healthcare name is worth a closer look and is our Stock of the Week.

Stock of the Week: Horizon Therapeutics (HZNP)

The company’s expertise is in rare diseases. Horizon’s lead product is Krystexxa, which is a treatment for uncontrollable gout. The company also received approval from the FDA for Tepezza last year, to treat thyroid eye disease. Management expects both of these blockbuster products to achieve peak annual sales of at least $1 billion.

The stock gained more than 2% this week. We believe this momentum can continue in the first half of 2021. Here’s why:

Horizon posted quarterly results on Wednesday that surpassed expectations. The company earned $1.28 a share in the fourth quarter of 2020, as revenue increased 105% from a year ago, to $745.3 million.

Earlier this month, Horizon acquired Viela Bio (VIE) for $3.05 billion of cash. The deal is expected to close by the end of the first quarter. Management will borrow $1.3 billion to help finance the purchase. Viela has just one approved treatment for a rare autoimmune disease. It is currently running two Phase 3 and another four Phase 2 trials in its clinical pipeline.

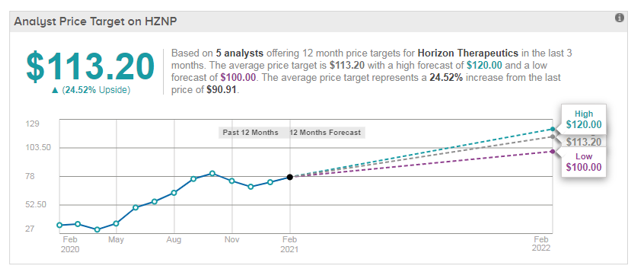

Wall Street Sees Upside Potential

All five analysts tracked by TipRanks rate the stock a Buy. The average price target of $113.20 represents 24.5% upside potential.

According to recent SEC filings, SEC hedge funds Paulson & Co. and Viking Global also both increased their stakes in Horizon.

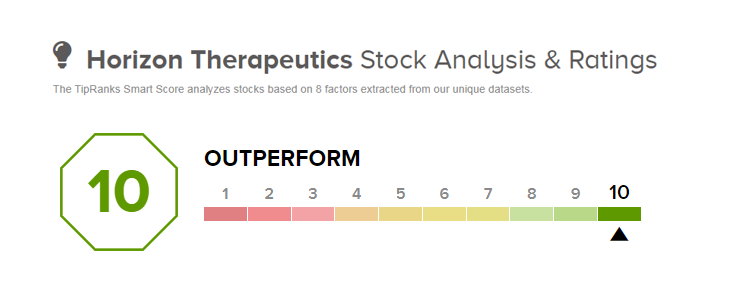

In addition, the company carries a Smart Score of 10/10 on TipRanks. This proprietary score utilizes Big Data to rank stocks based on 8 key factors that have historically been a precursor of future outperformance.

On top of the positive aspects mentioned already, the Smart Score indicates that shares have seen improving sentiment from financial bloggers.

FYI: This is just 1 of the 20+ stocks selected for the Smart Investor portfolio. That’s where we share more detailed insights on our weekly stock picks.