The broader U.S. market averages ticked lower this week, on relatively low volume. Trading activity was cut to three-and-a-half days because of the Christmas holiday.

Wall Street and Main Street both received welcome news on Sunday, as Congress passed a $908 billion economic relief program. The majority of the funds would go to small businesses and individuals. Money would also be allocated toward schools and public spending for the COVID-19 pandemic.

President Trump has yet to sign the bill. He says he wants to increase payouts for qualified individuals from $600 to $2,000.

Meanwhile, outside of the U.S., the U.K. finalized its “Brexit” from the European Union on Thursday.

Coronavirus Update

It may no longer be the top news story in the financial press, but the coronavirus pandemic is still with us.

Two vaccines are now being rolled out across the globe. Meanwhile this week we crossed the tragic milestone of 80 million reported cases worldwide.

If the pandemic continues to persist, it could hamper the positive trajectory of the economic recovery as we head into 2021.

What to Expect Next Week

We expect that trading will remain relatively slow in the final days of 2020. Most professional investors have already closed up shop for the year.

Following the snap-back recovery in stocks from March lows, we believe that investment gains will be harder to come by in 2021.

As a result, deciding what and when to buy can be challenging for any investor. However, the fact remains that attractive investments are out there, if you’re willing to dig a little deeper.

One such Technology name is worth a closer look and is our Stock of the Week.

Stock of the Week: TechTarget (TTGT)

The company provides marketing services that match technology vendors with potential business customers, utilizing data analytics.

The stock gained nearly 6% this week and we believe this momentum can continue as the calendar changes to 2021. Here’s why:

Earlier this month, management said that fourth quarter revenue was trending above guidance of $42 to $43 million. TechTarget had previously surpassed both sales and earnings expectations two straight quarters.

The company also recently announced that it acquired privately-held BrightTalk, for $150 million of cash. The deal is expected to be accretive to adjusted EBITDA upon closing.

BrightTalk allows companies to create video marketing content. It generated about $50 million of revenue in 2020, representing 30% annual growth. The business generates about half of its sales from long-term contracts, which is a direction that TechTarget is moving toward.

Even before this purchase, the company had an attractive growth outlook. Profit is expected to average 50.6% improvement over the next two years, to $1.36 a share in 2021. The stock is currently valued at 44.5x forward earnings, which is a discount to its growth rate.

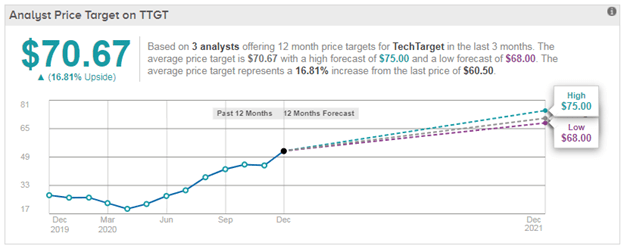

Wall Street agrees that TechTarget is attractively valued. All three active analysts tracked by TipRanks rate the stock a Buy. The average price target of $70.67 represents 16.8% upside potential.

In addition, it’s worth noting that the company carries a Smart Score of 10/10 on TipRanks. This proprietary score utilizes Big Data to rank stocks based on 8 key factors that have historically been a precursor of future outperformance.

On top of the positive aspects mentioned already, the Smart Score indicates that the shares have seen improving sentiment from hedge funds and financial bloggers.

FYI: This is just 1 of the 20+ stocks selected for the Smart Investor portfolio. That’s where we share more detailed insights on our weekly stock picks.