U.S. stocks rallied on Thursday, as the S&P 500 crossed and closed above 4,000 for the first time. Even though financial markets were closed on Friday for a holiday, the March employment report still wowed investors.

The U.S. economy added 916,000 non-farm payrolls last month, driven primarily from gains in the Hospitality and Leisure sector. The figure from February was also revised higher by 89,000. Elsewhere, the headline unemployment rate fell to 6% and 347,000 workers re-entered the labor force in March.

In other economic news, February consumer confidence came in well ahead of expectations on Tuesday. The reading hit 109.7 and marked the highest monthly increase in nearly 18 years.

The consumer recovery is being aided by government stimulus efforts. President Biden’s next economic strategy was unveiled on Wednesday, as a $2.25 trillion infrastructure plan.

In addition to roads, bridges and other public works, the plan includes projects for clean energy and improved care for the elderly and disabled. The deal is expected to be hotly debated in Congress, especially as it is proposed to be partially funded by higher corporate taxes.

The Week Ahead

Investors will return from an extended weekend to a relatively quiet calendar. The highlight next week will likely be Friday’s producer price index (PPI) report. Businesses have been experiencing rising prices since the beginning of the year and economists are looking for further growth in this area during March.

While the Federal Reserve has stated it will let inflation run higher than usual to support a post-pandemic jobs recovery, a high PPI reading could still spook the markets.

Following the snap-back recovery in stocks last year from Pandemic lows, we believe that investment gains will be harder to come by in 2021.

As a result, deciding what and when to buy can be challenging for any investor. However, the fact remains that attractive investments are out there if you’re willing to dig a little deeper.

One such Healthcare name is worth a closer look and is our Stock of the Week.

Stock of the Week: Henry Schein (HSIC)

The company sells equipment to dentists and other medical practitioners.

The stock gained fractionally this week and we believe this momentum can continue in the first half of 2021. Here’s why:

Henry Schein’s business is not traditionally cyclical; however, dental offices were running at reduced capacity during the pandemic and some patients delayed routine visits while COVID-19 infection rates were steadily rising.

Now that vaccine distribution is ramping up and restrictions are being loosened, we believe the company’s business could rebound in 2021.

That upbeat outlook was apparent in better-than-expected quarterly results posted in February. Henry Schein earned $1 a share in the fourth quarter of 2020, as revenue increased 18% from a year ago, to $3.17 billion.

Upside in the period was driven by higher international sales growth, where the company generates about 30% of revenue and is a beneficiary of the weaker U.S. dollar. Looking forward, management expects 2021 profit to be above pre-pandemic levels.

In the meantime, the stock is valued at 18.5x expected full-year earnings of $3.72 a share. That represents a discount to both the broader market and the median industry valuation of 20x. Last month, Henry Schein said that it expects to take advantage of this discount valuation and resume buying back shares on the open market.

Analysts agree that the company holds value. The average price target of five active analysts tracked by TipRanks is $81.20, which represents 18.3% upside potential.

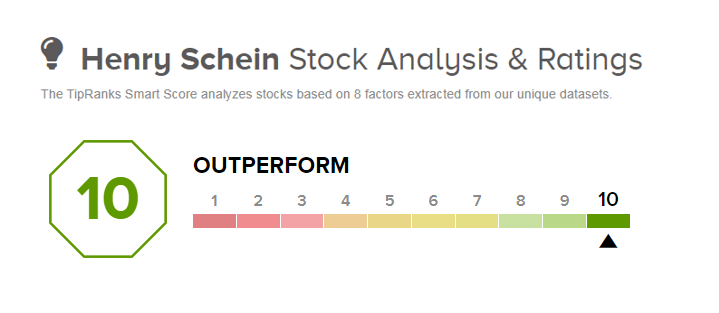

In addition, the company carries a Smart Score of 10/10 on TipRanks. This proprietary score utilizes Big Data to rank stocks based on 8 key factors that have historically been a precursor of future outperformance.

On top of the positive aspects mentioned already, the Smart Score indicates that shares have seen improving sentiment from investors and financial bloggers.

FYI: This is just 1 of the 20+ stocks selected for the Smart Investor portfolio. That’s where we share more detailed insights on our weekly stock picks.