The broader U.S. market averages kicked off May with gains of at least 1% across the board last week. Cyclical groups, such as Energy and Materials led the way higher, while Consumer Discretionary stocks fell.

All eyes were on the economy last week and Friday’s jobs data provided a big surprise. The U.S. added just 266,000 non-farm payrolls in April, compared with expectations of 1 million.

The are several potential reasons for the headline miss, but the net result is that it gives the Federal Reserve more reason to hold short-term interest rates lower, in its mission to support a full jobs recovery in the post-pandemic economy.

Earnings Season

Earnings season effectively wraps up this week, with just 18 companies in the S&P 500 expected to post quarterly results. Marriott (MAR) and Walt Disney (DIS) highlight the reporting calendar.

To date, seven of eight companies in the S&P 500 have exceeded the consensus analyst profit estimate. According to Refinitiv, aggregate S&P 500 earnings are expected to increase nearly 50% year-over-year in the first quarter, up from an estimate of 46% just a week ago.

The Week Ahead

It will be a busy week on the economic front, with inflation data in focus. We’ll get the April consumer price index (CPI) on Wednesday, followed by the producer price index (PPI) 24 hours later.

Consensus expectations call for the core CPI to top 2% year-over-year growth for the first time since the pandemic began. Friday also offers a look at the April advance retail sales, providing information about the health of the consumer.

Following the snap-back recovery in stocks last year from Pandemic lows, we believe that investment gains will be harder to come by in 2021.

As a result, deciding what and when to buy can be challenging for any investor.

However, the fact remains that attractive investments are out there, if you’re willing to dig a little deeper.

One such Media name is worth a closer look and is our Stock of the Week.

Stock of the Week: iHeartMedia (IHRT)

The company distributes broadcast radio and podcasts through streaming services. The stock gained 18% last week and we believe this momentum can continue into the second half of 2021. Here’s why:

Management posted quarterly results on Thursday that exceeded expectations. iHeartMedia reported revenue of $707 million in the first quarter, which was down 9% from a year ago.

Despite the headline sales decline, it’s momentum in the company’s digital business that has investors excited. Back in February, management announced an organizational restructuring, to focus on it rapidly-growing podcast business.

Working against weak comparisons from the previous year, iHeartMedia said that April revenue increased 85% year-over-year, including 170% growth from podcasts. For the full second quarter, the company is targeting 65% sales growth.

Following the results, Wells Fargo analyst Steven Cahall boosted his price target on the stock to a Street-high of $28, representing 23.7% upside potential.

Insiders also see value in iHeartMedia, as CEO Robert Pittman bought $200,000 worth of shares in March, on the open market. There are several reasons why insiders may sell a stock, but they usually only buy when upbeat about the near-term prospects. Arguably, no one understands a business better than its top executives.

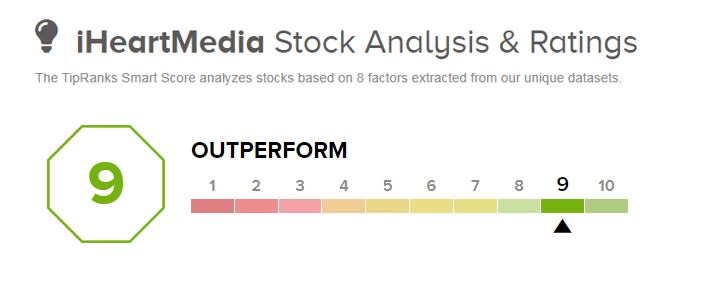

The company also carries a Smart Score of 9/10 on TipRanks. This proprietary score utilizes Big Data to rank stocks based on 8 key factors that have historically been a precursor of future outperformance.

On top of the positive aspects mentioned already, the Smart Score indicates that shares have seen improving sentiment from individual investors and financial bloggers.

FYI: This is just 1 of the 20+ stocks selected for the Smart Investor portfolio. That’s where we share more detailed insights on our weekly stock picks.