Waste Management, Inc. (WM) is a provider of waste management and environmental services in North America. The company reported better-than-expected second-quarter results driven by an accelerated volume recovery across all segments. Following the announcement, shares hit an all-time high of $149.95 on July 27. (See Waste Management stock charts on TipRanks)

In the second quarter, the company reported earnings of $1.27 per share, up 44.3% year-over-year, and beat analysts’ estimates of $1.18 per share.

Revenue came in at $4.48 billion, growing 25.8% compared to the year-ago period, and surpassed the consensus estimate of $4.23 billion.

President and CEO Jim Fish said, “The acquisition of Advanced Disposal, the return of volumes from early pandemic levels, and our continued focus on cost control all contributed to financial outcomes that exceeded expectations.”

The company undertook disciplined pricing and cost management steps to offset inflationary cost pressures in the first half of FY21. The company expects to maintain the same focus for the rest of the year, and as a result, the company has raised its fiscal 2021 revenue guidance to grow by 15.5% – 16% annually.

Moreover, the company expects to buy back additional shares worth $850 million through the rest of the year, in line with its $1.35 billion authorized share buyback program.

Following the results, Morgan Stanley analyst Jeffrey Goldstein reiterated a Hold rating on the stock while lifting the price target to $154 (4.8% upside potential) from $150.

Overall, the stock has a Moderate Buy consensus rating based on 5 Buys, 3 Holds, and 1 Sell. The average Waste Management price target of $151.11 implies 2.8% upside potential to current levels. Shares have gained 36.7% over the past year.

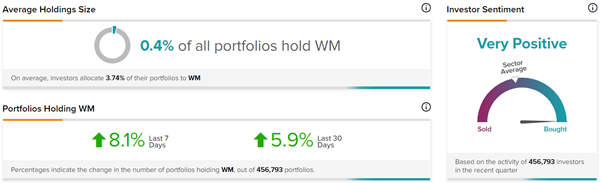

Also, TipRanks’ Stock Investors tool shows that investors currently have a Very Positive stance on Waste Management, with 8.1% of portfolios tracked by TipRanks increasing their exposure to WM stock in the last 7 days.

Related News:

AMD Delivers Stellar Q2 Results, Beats Expectations

Microsoft Beats Expectations with Robust Q4 Results

IDEX Misses Q2 Earnings, Raises Guidance