Waste Management announced a 5.5% increase in its quarterly dividend per share from $0.545 to $0.575 and an update about its share repurchase program. The company expects to make the first increased dividend payment in March 2021.

The dividend hike brings Waste Management’s (WM) annual dividend per share to $2.30 from $2.18. The company also received authorization from its Board of Directors to repurchase up to $1.35 billion of its common stock, superseding the authority remaining under the existing $1.5 billion authorization announced in 2018.

Waste Management’s CEO Jim Fish stated, “For eighteen consecutive years we have been able to increase our dividends due to the strength of our business and the growth in our free cash flow generation. We have a resilient business model and expect to continue to perform well in the coming years, positioning us to confidently increase our 2021 dividend rate.” (See WM stock analysis on TipRanks)

“Now that we have closed the acquisition of Advanced Disposal, our remaining capital allocation plan, after paying our dividend, will initially focus on strengthening our balance sheet to quickly return to our targeted leverage ratio of 2.5 times to 3 times. We anticipate achieving that level in 2021,” added CEO Fish.

Last month, Oppenheimer analyst Noah Kaye increased the price target on Waste Management to $128 from $123 and reiterated a Buy rating following the company’s 3Q results. Kaye also increased estimates to reflect organic trends and the Advanced Disposal acquisition. The analyst believes that the company’s pricing trajectory appears to be back on track as collection and disposal yield improved by 130 basis points sequentially and management indicated that further improvement is likely in 4Q.

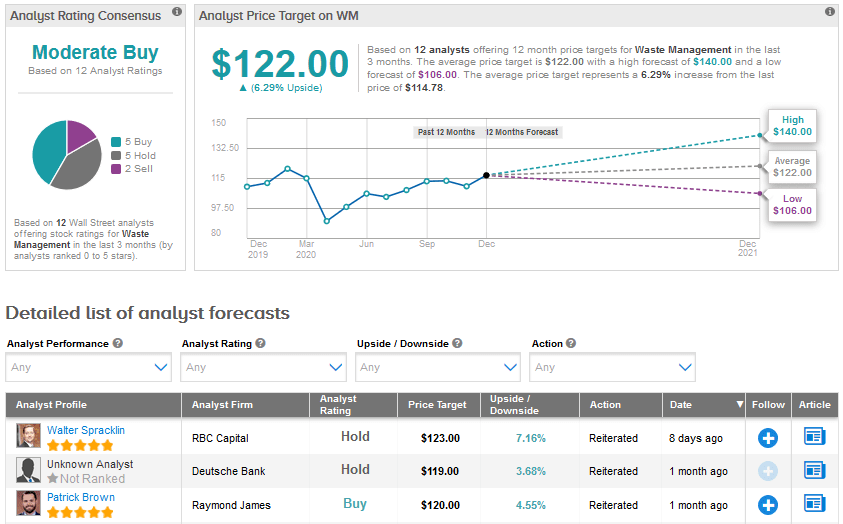

Waste Management shares have risen by only 0.72% year-to-date and the average price target of $122 indicates an upside potential of 6.3% from current levels. The Street has a cautiously optimistic Moderate Buy analyst consensus that breaks down into 5 Buys, 5 Holds and 2 Sells.

Related News:

Honeywell Snaps Up Australia’s Sine Group; Shares Up 20% YTD

GM To Inject $76M To Ramp Up Pickup Truck Production; Street Bullish

NIO Shares Fall On Discounted Offering Price