Walt Disney Co. (DIS) has renewed its content carriage agreement with Comcast (CMCSA) to provide its Xfinity customers access to various content across Comcast’s superior platforms.

Xfinity offers live, on-demand and streaming entertainment to customers through its X1 and Flex devices, which are accessible with the Xfinity Voice Remote.

Shares of the California-based entertainment and media conglomerate were down 2% on November 30 to close at $144.90.

See Analysts’ Top Stocks on TipRanks >>

Details of the Deal

According to the agreement, Comcast will continue the distribution of Disney’s cable channels, including the ESPN networks, the Disney-branded channels, Freeform, the FX networks, and the National Geographic channels.

The distribution will include sports, news, kids, family, and general entertainment programming for its Xfinity TV customers. Furthermore, Atlantic Coast Conference followers will gain access to the multiplatform network in the coming weeks as Comcast will distribute the ACC Network to its Xfinity customers.

Management Weighs In

EVP of Platform Distribution at Disney, Sean Breen, commented, “We’re very happy to extend our longstanding relationship with Comcast and continue to provide their Xfinity customers with Disney’s best-in-class programming.”

He further added, “In addition to our news, sports and general entertainment offerings, the launch of the ACC Network in the coming weeks, paired with the renewal of the SEC Network, will give Xfinity’s college sports fans long-awaited access to their favorite games.”

Analysts Recommendation

On November 29, Loop Capital analyst Alan Gould decreased the price target on Disney to $190 (31.1% upside potential) from $205, and reiterated a Buy rating.

Gould believes that Disney+ profits will be pressured over the coming years after the company announced a higher-than-anticipated increase in content spend.

However, he thinks that streaming will continue to win share from linear viewing and Disney should be the winner based on its content, brands, and service.

The Wall Street community is cautiously optimistic about the stock, with a Moderate Buy consensus rating based on 17 Buys and 6 Holds. The average Walt Disney price target of $204.38 implies 41.1% upside potential.

Website Traffic

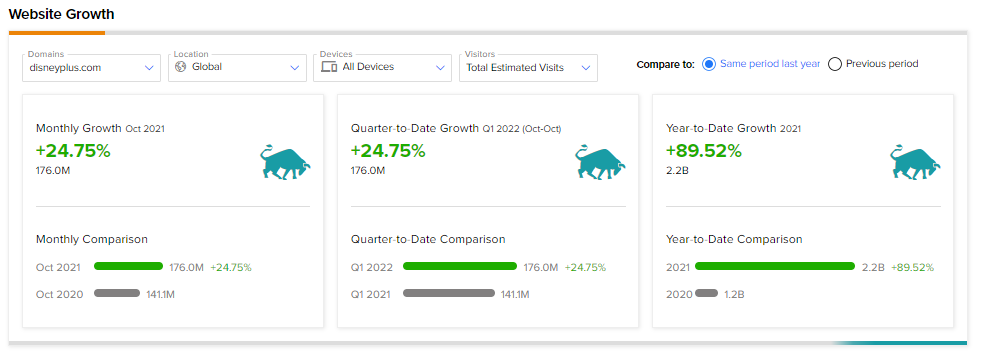

TipRanks’ Website Traffic Tool, which uses data from SEMrush Holdings (SEMR), the world’s biggest website usage monitoring service, offers insight into Walt Disney’s performance.

According to the tool, the company’s website traffic registered a 24.75% increase in global visits in October. Moreover, website traffic has risen 89.5% year-to-date.

Related News:

Chegg Shares Rise 4% on Bussu Acquisition & Buybacks

Twitter CTO Parag Agrawal Replaces CEO Jack Dorsey

Accenture Renews Joint Investments with AWS