Walmart (WMT) announced that it has teamed up with Symbotic to install its high-tech automation system in 25 Walmart distribution centers to create a robust, smooth, and faster retail experience for consumers.

Currently, Walmart has a $394 billion market capitalization, and its shares have gained over 7% over the past year. (See WMT stock charts on TipRanks)

Symbotic is a robotics and automation-based company providing cutting-edge technology to increase supply chain efficiency for retailers and wholesalers in the U.S.

The integration of Symbotic’s system, which includes a range of fully autonomous robots and its proprietary software, will not only lead to the modernization and digitization of its existing supply chain facilities but will also boost productivity and warehouse capacity and bring down costs.

Joe Metzger, EVP of supply chain operations at Walmart U.S., commented, “The digital transformation happening today, alongside evolving customer habits, is reshaping the retail industry.”

He further added, “To serve customers now, and in the future, our business must provide the right tools and training to our associates so they can deliver the items our customers want, when they want them, with unmatched convenience. We’re investing in our supply chain at an unprecedented scale in order to optimize that process end-to-end.”

Morgan Stanley analyst Simeon Gutman recently reiterated a Buy rating and the price target of $160 (13% upside potential) on the stock.

Gutman said the “stock is looking interesting,” despite his belief that an inflection looks doubtful in the short term based on Walmart+ membership levels that have been “treading water” in the range of 9 – 10 million members since March, and a “high overlap” with Amazon Prime.

Consensus among analysts is a Strong Buy based on 15 Buys and 4 Holds. The average Walmart price target of $167.24 implies 18.2% upside potential to current levels.

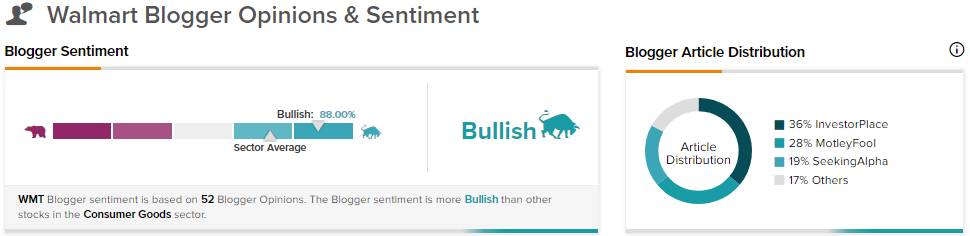

TipRanks data shows that financial blogger opinions are 88% Bullish on WMT, compared to a sector average of 72%.

Related News:

PepsiCo Shares Jump 2.3% on Q2 Beat and Raised Guidance

Goldman Sachs Reports Blowout Q2 Results; Hikes Dividend by 60%

Organigram Bounces 11% on Q3 Revenue Beat