With a resurgent virus in the background, the stock market continues to remain volatile. TipRanks brings you the latest analyst action on some of your favorite stocks to sail smoothly through the market volatility. Let’s look into the noteworthy bullish and bearish calls of the day and see what the top Wall Street analysts are recommending.

Upgrades

1. Hawaiian Holdings

Wolfe Research analyst Hunter Keay upgraded Hawaiian Holdings (HA) to Buy from Hold and maintained a price target of $32 citing the company’s current valuation. Keay likes the niche that Hawaiian holds in the recovery of the airline space and raised his estimates following the release of its 1Q earnings.

The Wall Street community is cautiously optimistic about the stock with a Moderate Buy consensus rating. That’s based on 2 Buys and 2 Holds. The average analyst price target of $29.25 implies 18.3% upside potential to current levels.

2. Cargojet Inc

Canaccord analyst Matthew Lee upgraded Cargojet (CGJTF) to Buy from Hold and increased the price target to C$220 from C$200. According to Lee, the recent sell-off creates a buying opportunity for the stock. Furthermore, the analyst prefers Cargojet based on its “resilient” business, contract stability, and potential to manage the “burgeoning” Canadian e-commerce industry.

TipRanks data shows that financial blogger opinions are 100% Bullish on CGJTF, compared to a sector average of 65%.

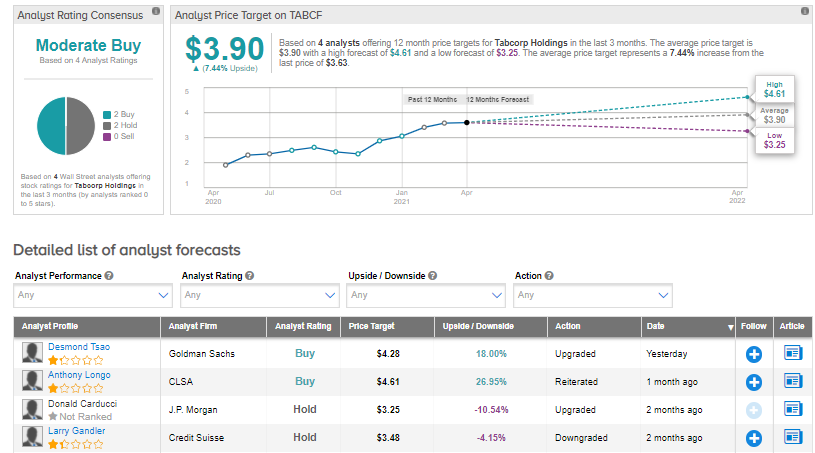

3. Tabcorp Holdings Limited

Goldman Sachs analyst Desmond Tsao upgraded Tabcorp Holdings (TABCF) to Buy from Hold and increased the price target to A$5.54 from A$4.38. In the current era of the shift to digital penetration, Tsao believes that the lottery industry is at an “inflection point”. Furthermore, the analyst foresees “further upside risks” to lottery sales following the expected changes in the OzLotto game.

The Wall Street community is cautiously optimistic about the stock with a Moderate Buy consensus rating based on 2 Buys and 2 Holds. The average analyst price target of $3.94 implies 8.5% upside potential to current levels.

4. ABB Ltd

J.P. Morgan analyst Andreas Willi upgraded ABB (ABB) to Hold from Sell and increased the price target to CHF 27.50 from CHF 25. In a note to investors, Willi said that ABB had preannounced a “strong” 1Q and the details of the report confirm a “high-quality” beat, with all divisions performing well. Furthermore, the analyst noted that strong 2Q margin guidance was provided despite expectations of building cost headwinds. Additionally, the analyst expects ABB to gain from accelerating electrification trends.

According to TipRanks’ Smart Score rating tool, ABB gets a 7 out of 10, which indicates that the stock is likely to perform in line with market averages.

5. Graphic Packaging

Seaport Global analyst Mark Weintraub upgraded Graphic Packaging (GPK) to Buy from Hold and maintained a price target of $22. According to Weintraub, though 2021 will be a “challenging year” due to inflationary pressures, the company actually has exceptionally strong fundamentals. Furthermore, the analyst expects big upside potential in 2022 and 2023 earnings.

Graphic Packaging scores a 9 of 10 from TipRanks’ Smart Score rating tool, indicating that the stock has strong potential to outperform market expectations.

Downgrades

1. FirstService Corporation

TD Securities analyst Daryl Young downgraded FirstService (FSV) to Hold from Buy but increased the price target to $180 from $175. Young believes that FirstService has an attractive “large and highly fragmented” market opportunity with the potential to increase its value through acquisitions. However, the analyst views these attributes as already priced into the current valuation.

TipRanks’ Hedge Fund Trading Activity tool shows that confidence in FirstService is currently Neutral, as 2 hedge funds decreased their cumulative holdings of the stock by 75,700 shares in the last quarter.

2. Fortis Inc

Raymond James analyst David Quezada downgraded Fortis (FTS) to Hold from Buy and maintained a price target of C$58. According to Quezada, some of the larger regulated utilities like Fortis are currently trading modestly above the midpoint of historical ranges, reflecting a 12%-14% rise from late February lows.

Despite the downgrade, TipRanks’ Stock Investors tool shows that investors currently have a Very Positive stance on Fortis, with 2.6% of investors increasing their exposure to FTS stock over the past 30 days.

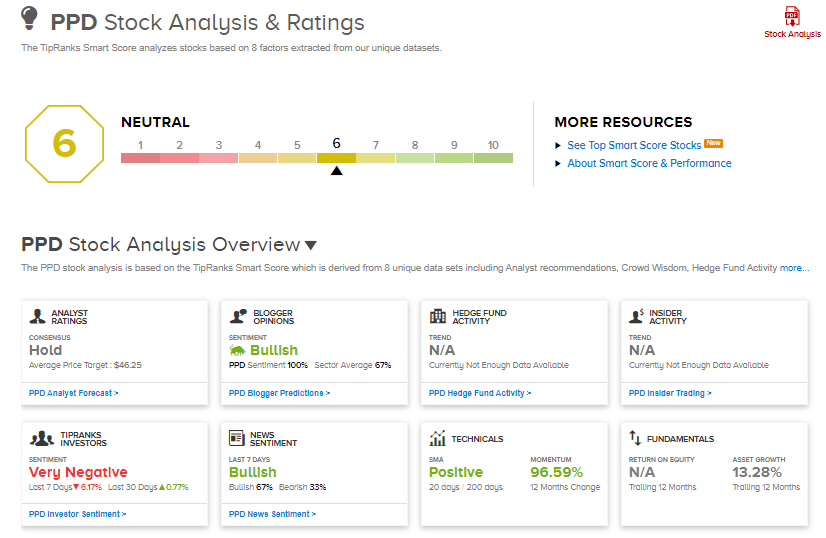

3. PPD

J.P. Morgan analyst Tycho Peterson downgraded PPD (PPD) to Hold from Buy and maintained a price target of $48 citing the pending acquisition by Thermo Fisher.

According to TipRanks’ Smart Score rating tool, PPD gets a 6 out of 10, which indicates that the stock is likely to perform in line with market averages.

4. Enphase Energy

Northland analyst Gus Richard downgraded Enphase Energy (ENPH) to Hold from Buy following the company’s first-quarter earnings report. According to Richard, growth is likely to be restricted in 2Q impacted by the tight supply of semiconductors. Furthermore, the analyst foresees limited upside potential in the near term, and therefore, “cannot reconcile the current bubble valuation”.

TipRanks’ Hedge Fund Trading Activity tool shows that confidence in Enphase Energy is currently Neutral, as 8 hedge funds decreased their cumulative holdings of the stock by 247,100 shares in the last quarter.

5. Cellectis SA

Guggenheim analyst Michael Schmidt downgraded Cellectis (CLLS) to Hold from Buy. Schmidt cited modest advancement in the company’s three proprietary pipeline programs and low visibility on the “key near-term value inflection points” as the reasons for the downgrade. Furthermore, the analyst said that the initial Phase 1 data from Cellectis’ UCARTCS1 program indicates continued and “potentially lengthy” protocol optimization.

According to TipRanks’ Smart Score rating tool, Cellectis gets a 6 out of 10, which indicates that the stock is likely to perform in line with market averages.

Besides the above, you can also have a look at the following:

Time to Bet on These 3 Sports Betting Stocks, Say Analysts

Amazon: Another Strong Earnings Report on the Way, Says Analyst

All Eyes on Apple Stock Ahead of Earnings; Analyst Says ‘Buy’

Dividend-Yield Calculator