The uncertainty regarding the pace of economic recovery has added to the volatility in the stock market. Amid volatility, TipRanks brings you the latest analyst action on some of your favorite stocks to help you navigate through the ups and downs. Let’s look into the top bullish and bearish calls of the day and see what the Wall Street experts are recommending.

Upgrades

1. Electronic Arts

Jefferies analyst Andrew Uerkwitz upgraded Electronic Arts (EA) to Buy from Hold and increased the price target to $165 from $140. In a note to investors, Uerkwitz said that investors have negative sentiments towards the stock, and underappreciate the company’s underlying assets. Meanwhile, the analyst foresees “green shoots” for Electronic Arts with expectations of more normalized growth, and he views the company’s valuation as reasonable.

TipRanks data shows that financial blogger opinions are 92% Bullish on EA, compared to a sector average of 67%.

2. SolarEdge Technologies

Barclays analyst Moses Sutton upgraded SolarEdge Technologies (SEDG) to Buy from Hold and increased the price target to $365 from $334. Based on underappreciation of upside potential from Kokam pricing and EnergyHub volume, Sutton believes that consensus estimates are too low. Considering SolarEdge as his new top pick in US solar, the analyst views the company as well-positioned to report strong 1Q earnings.

The Wall Street community is cautiously optimistic about the stock with a Moderate Buy consensus rating. That’s based on 8 Buys, 5 Holds, and 2 Sells. The average analyst price target of $333.17 implies 21.3% upside potential to current levels.

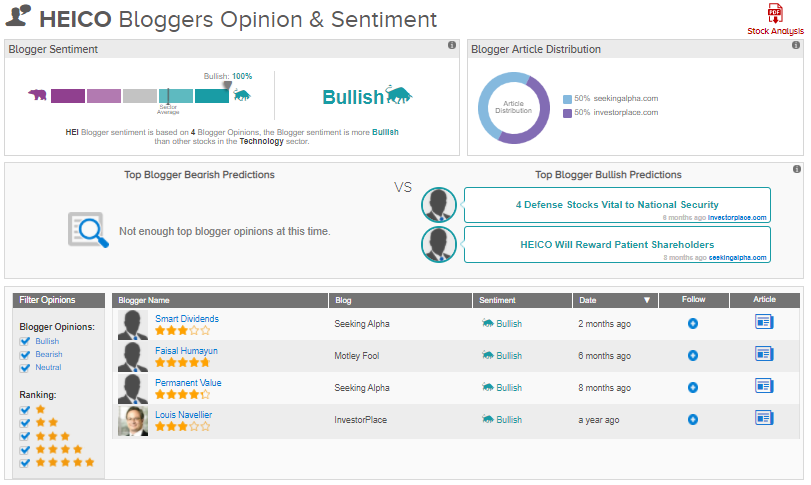

3. Heico Corp.

Canaccord Genuity analyst Kenneth Herbert upgraded Heico (HEI) to Buy from Hold and increased the price target to $150 from $130. Herbert believes “the recent underperformance (stock is up just 2% YTD vs 10% for the A&D sector) represents an opportunity. Granted, the stock had a significant outperformance in 2020, but we believe the improving prospects for the commercial aerospace aftermarket (AM) will support improved sentiment on the stock…While multiples are well ahead of historical averages for HEI, we believe the improving fundamentals, margin expansion, defense upside, balance sheet strength, and capital allocation opportunities will support the valuation premium.”

TipRanks data shows that financial blogger opinions are 100% Bullish on Heico, compared to a sector average of 67%.

4. Cimarex Energy

MKM Partners analyst John Gerdes upgraded Cimarex Energy (XEC) to Buy from Hold and increased the price target to $78 from $75 citing the stock’s depreciation of more than 10% since early March, which reflects 30% upside potential in equity value. Furthermore, Gerdes foresees Cimarex generating free cash flows of about $750 million in 2021, based on the assumption of capex of around $800 million.

The consensus rating among analysts is a Strong Buy based on 13 Buys and 2 Holds. The average analyst price target stands at $75.64 and implies upside potential of 24.5% to current levels.

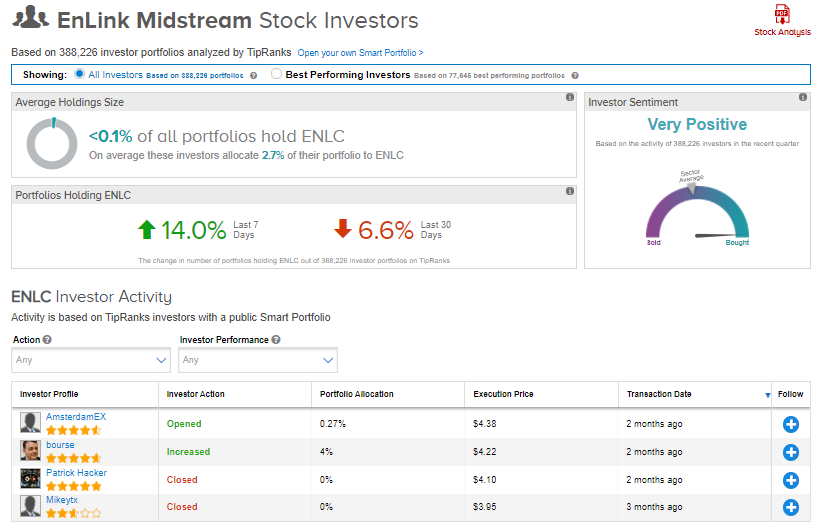

5. EnLink Midstream LLC

UBS analyst Shneur Gershuni upgraded EnLink Midstream (ENLC) to Buy from Hold and increased the price target to $6 from $4.50. Though investors expect the company’s EBITA growth to be flat to down, Gershuni foresees “modest” growth in 2022 after “bottoming out” in 2021.

TipRanks’ Stock Investors tool shows that investors currently have a Very Positive stance on EnLink Midstream, with 14% of investors increasing their exposure to ENLC stock over the seven days.

Downgrades

1. Harley-Davidson

Morgan Stanley analyst Billy Kovanis downgraded Harley-Davidson (HOG) to Sell from Hold but increased the price target to $38 from $36. In a note to investors, Kovanis said that though the CEO’s comments indicate increasing profitability with high expectations which has given hope to investors, Harley-Davidson is currently facing secular headwinds.

TipRanks’ Stock Investors tool shows that investors have a Very Negative stance on Harley-Davidson, with 7.6% of investors decreasing their exposure to HOG stock over the last 30 days.

2. Braskem SA

HSBC analyst Lilyanna Yang downgraded Braskem (BAK) to Hold from Buy but increased the price target to $20 from $13 citing the company’s current valuation. Meanwhile, Yang expects Braskem to report “another strong quarter” this earnings season following high petrochems spreads across the Americas.

According to TipRanks’ Smart Score system, Braskem gets a 7 out of 10, which indicates that the stock is likely to perform in line with market averages.

3. ATCO Ltd.

Credit Suisse analyst Andrew Kuske downgraded Atco (ACLLF) to Hold from Buy but increased the price target to C$46.50 from C$45. Kuske cited the company’s valuation as the reason for the downgrade, given the “limited excess potential return” at current price levels.

The Wall Street community is cautiously optimistic about the stock with a Moderate Buy consensus rating. That’s based on 1 analyst suggesting a Buy and 3 analysts recommending a Hold. The average analyst price target of $36.24 implies 6.4% upside potential to current levels.

4. Planet Fitness

Piper Sandler analyst Peter Keith downgraded Planet Fitness (PLNT) to Hold from Buy citing uncertainty in the speed of the company’s recovery, and the belief that a “bull case” is already priced into the stock. Based on Piper’s annual fitness survey, the pace of membership and earnings recovery in 2022 “now looks less certain” for Planet Fitness. Furthermore, the analyst noted that the survey indicates a decline in both new member interest and existing member retention, with both metrics reflecting the lowest levels since April 2020. The analyst maintained a price target of $87.

TipRanks’ Hedge Fund Trading Activity tool shows that confidence in Planet Fitness is currently Neutral, as 6 hedge funds increased their cumulative holdings of the stock by 33,000 shares in the last quarter.

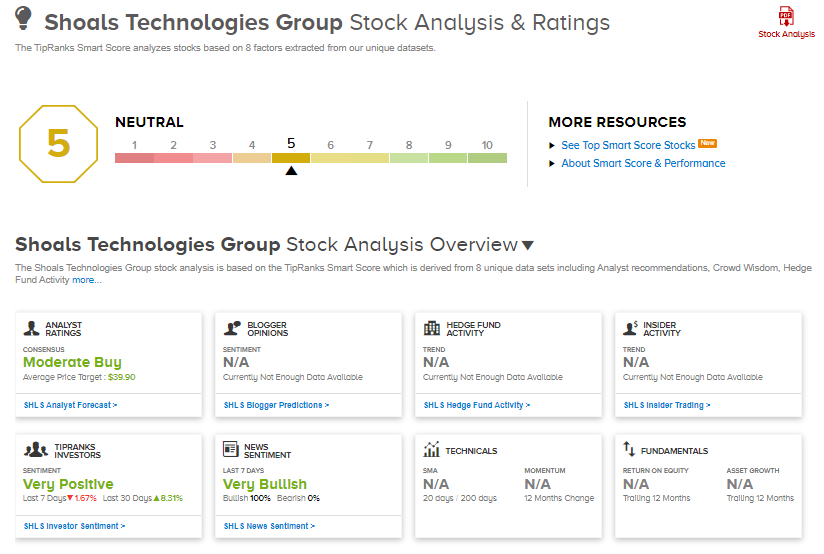

5. Shoals Technologies Group

Barclays analyst Moses Sutton downgraded Shoals Technologies (SHLS) to Hold from Buy and decreased the price target to $35 from $49. According to Sutton, investors should not “over-concentrate” in US solar in the first-quarter earnings season, and should rather prioritize “high-quality, diversified, and proven names” in the sector.

According to TipRanks’ Smart Score system, Shoals Technologies gets a 5 out of 10, which indicates that the stock is likely to perform in line with market averages.

Besides the above, you can also have a look at the following:

3 Top Growth Stocks to Buy Today

There’s an Opportunity Brewing in Ocugen Stock, Says Analyst

CureVac: Multiple Potential Catalysts Could Send Shares On An Upward Trajectory

Dividend-Yield Calculator