Retail pharmacy chains Walgreens and CVS Health have been struggling to fight intense competition from Amazon and Walmart. They have also been under pressure due to decline in reimbursement rates and lower prices of generic drugs.

Aside from enhancing their digital capabilities, Walgreens and CVS have been aggressively focusing on healthcare services to improve their revenues.

Using the TipRanks’ Stock Comparison tool, we will compare these two drug store chains to see which stock offers the most compelling investment opportunity.

Walgreens Boots Alliance (WBA)

Even before the COVID-19 pandemic, Walgreens was finding it difficult to thrive due to a competitive retail environment and changing dynamics in the pharmacy space. Moreover, vertical consolidation in the US healthcare industry has impacted the company’s growth and margins.

The company is facing additional headwinds amid the pandemic as store footfall has been hit by the coronavirus outbreak and social distancing orders. The impact was more profound on the company’s UK business, which reflected in a $2 billion impairment charge in its Boots UK business in the fiscal third quarter (ended May 31). However, an unprecedented online demand in the current crisis has been helpful.

Walgreens’ fiscal third-quarter sales of $34.63 billion grew by just 0.1% year-over-year as the strength in the company’s Retail Pharmacy USA business was offset by weakness in its international operations.

The Retail Pharmacy USA business gained from higher brand inflation and increased specialty sales despite lower prescription volume owing to a decline in doctor visits and hospital admissions amid the lockdowns. Excluding impairment and other one-time items, Walgreens’ EPS declined about 44% to $0.83 in the fiscal third quarter.

Higher fulfillment costs associated with increased online orders in the current crisis and the shift to lower-margin essentials are hurting the company’s margins. To improve its profitability, Walgreens aims to generate annual cost savings target of over $2 billion by 2022. As part of its transformation plan for the Boots UK and opticians businesses, the company intends to cut over 4,000 positions.

At the same time, Walgreens is enhancing its capacity to meet a surge in the demand for home delivery and online services triggered by the pandemic. In July, it collaborated with Village MD to open 500 to 700 physician-led primary care clinics in over 30 US markets over the next five years. The partnership will also enable round the clock care via telehealth and at-home visits.

The company has struck deals with several other local health providers to facilitate in-store and online health services.

And it has partnered with Microsoft to develop new healthcare delivery offerings and technology solutions to address the evolving needs in the industry. It recently expanded the Walgreens Find Care platform to offer a COVID-19 Risk Assessment feature powered by Microsoft’s Healthcare Bot.

In July, Walgreens announced that Stefano Pessina will step down as the CEO of the company and assume the role of executive chairman once a new CEO is appointed. Pessina, Walgreens’ largest shareholder, has been serving as the CEO following the merger between Walgreens and Alliance Boots in 2015.

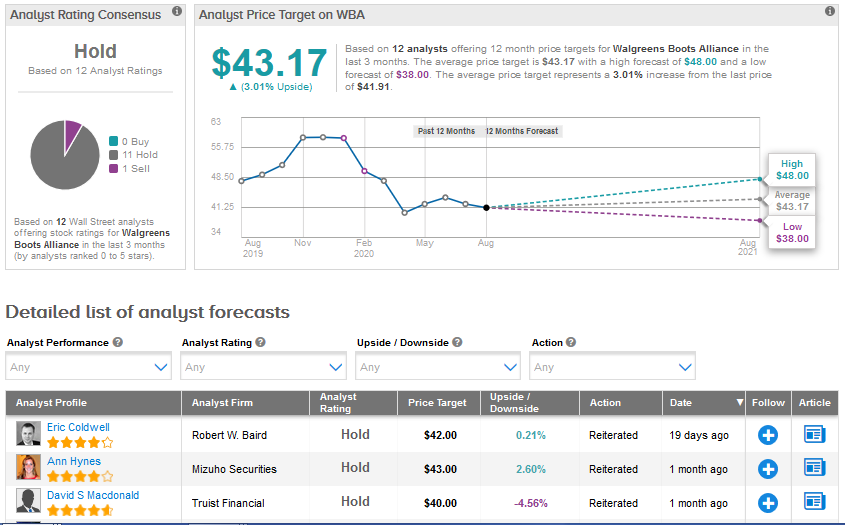

On July 28, Robert W. Baird analyst Eric Coldwell reaffirmed his Neutral rating for Walgreens with a price target of $42. Coldwell believes that the CEO transition will bring a fresh perspective for the struggling pharmacy chain. (See Walgreens stock analysis on TipRanks)

The Street’s consensus rating of Hold breaks down into 11 Holds and 1 Sell with no analyst currently assigning a Buy rating for Walgreens stock. The average price target of $43.17 signifies an upside of 3.0% over the next 12 months.

CVS Health (CVS)

CVS health’s diverse business model is helping it face the COVID-19 crisis. The shelter-at-home mandates hurt the company’s front store revenue and fewer doctor visits impacted the prescriptions filled in the second quarter. However, the company’s Health Care Benefits segment, which includes Aetna, is doing well amid the pandemic.

CVS was able to grow its second-quarter revenue by 3.0% to $65.34 billion as the Health Care Benefits business saw strong membership growth in government products and also benefited from the reinstatement of the Affordable Care Act Health Insurance Fee or HIF for 2020.

The company’s second-quarter adjusted EPS surged about 40% year-over-year to $2.64 as the Health Care Benefits business saw lower benefit costs with individuals deferring their elective medical procedures. The strong results made the company raise its 2020 adjusted EPS guidance to the range of $7.14 to $7.27 compared to the previous guidance of $7.04 to $7.17.

Since the pandemic, CVS has offered several products and services to address the growing healthcare needs. It is operating community testing sites at more than 1,800 of its drive-through locations.

It has also launched “Return Ready” COVID-19 testing solution for its Aetna and Caremark clients. More than 40 organizations have enrolled in this return-to-work testing program and the company disclosed that there are over 1,000 prospective clients.

CVS is also offering diagnostic testing for seniors in long-term care facilities. The company is transforming some of its stores to HealthHubs, which provide enhanced health services. CVS aims to increase the number of HealthHubs from 205 locations to 1,500 by the end of next year. And it is also expanding its virtual care offerings, including the E-Clinic telehealth option which helps patients consult qualified health care providers.

CVS is taking steps to support increased at-home services demand. The company’s retail prescription volume rose over 500% sequentially in the second quarter. Overall, CVS believes that the new customers gained during this crisis will drive long-term growth.

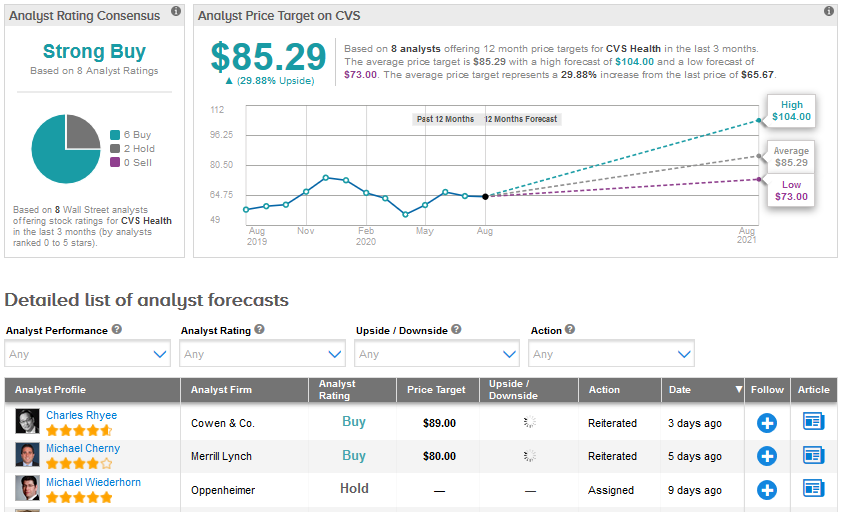

Following recent results, Merrill Lynch analyst Michael Cherny reiterated a Buy rating for CVS stock with a price target of $80. The four-star analyst described the company’s performance as “more good than bad”. Improving profitability with “incredibly healthy” free cash flow and a discounted valuation support Cherny’s bullish stance. (See CVS stock analysis on TipRanks)

A consensus Strong Buy rating, which breaks down into 6 Buys and 2 Holds, reflects the Street’s optimism. An average price target of $85.29 implies a strong upside potential of about 30%.

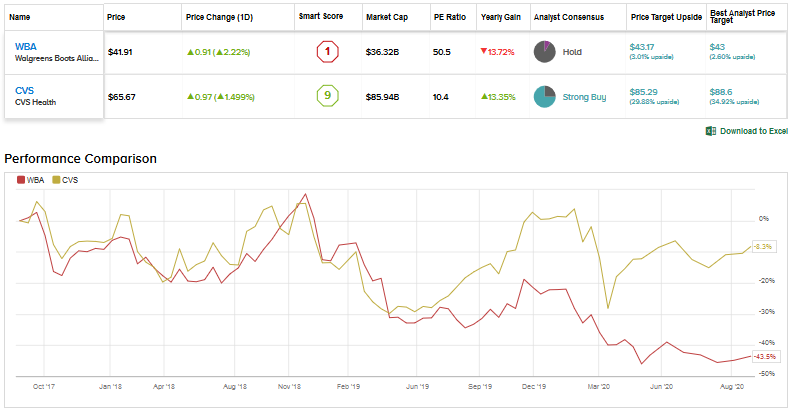

Walgreens and CVS stocks have declined about 29% and 12%, respectively, year-to-date. Walgreen’s has a higher dividend yield of 4.46% compared to CVS’ 3.05%. However, a diversified business model, discounted valuation, a strong upside potential in the stock and the consensus analyst rating speak in favor of CVS stock.

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment