Walgreens Boots Alliance Inc. (WBA) reported a $1.71 billion quarterly loss and announced 4,000 jobs cuts due to the impact of the coronavirus pandemic sending shares down 8%.

The stock dropped to $39.01 at the close on Thursday after the drugstore chain operator announced that it will also suspend its share repurchase program and will need to take a non-cash impairment charge of $2 billion mainly as result of the COVID-19 impact on its Boots UK business. As part of a restructuring plan to cut costs, Walgreens said it will close 48 of its Boots opticians stores and lay off 4,000 employees, or 7% of its workforce.

Net loss was $1.71 billion, or $1.95 per share, in the three months ended May 31, versus a profit of $1.03 billion, or $1.13 per share, in the year-earlier period. Analysts on average had expected adjusted earnings of $1.19 per share. Revenue rose 0.1% to $34.6 billion.

“Prior to the pandemic our financial performance for fiscal 2020 was on track with our expectations. However, this unprecedented global crisis led to a loss in the quarter as stay-at-home orders affected all of our markets,” Walgreens CEO Stefano Pessina said. “Shopping patterns are evolving more rapidly than ever as consumers further embrace digital options, spurring us to accelerate our ongoing investments in digital transformation and neighborhood health destinations.”

Walgreens total digitally initiated sales rose 22.7% in the third quarter, compared with the same period last year. The drugstore chain recently formed a strategic partnership with Microsoft (MSFT) and Adobe to launch a marketing technology and customer data platform for personalized healthcare and shopping experiences.

Earlier this week, Walgreens announced that it will be expanding the size of its care clinics by nearly 700 retail stores over the next few years as part of an overhaul of its business model from being primarily a drug pharmacy to a primary care clinic.

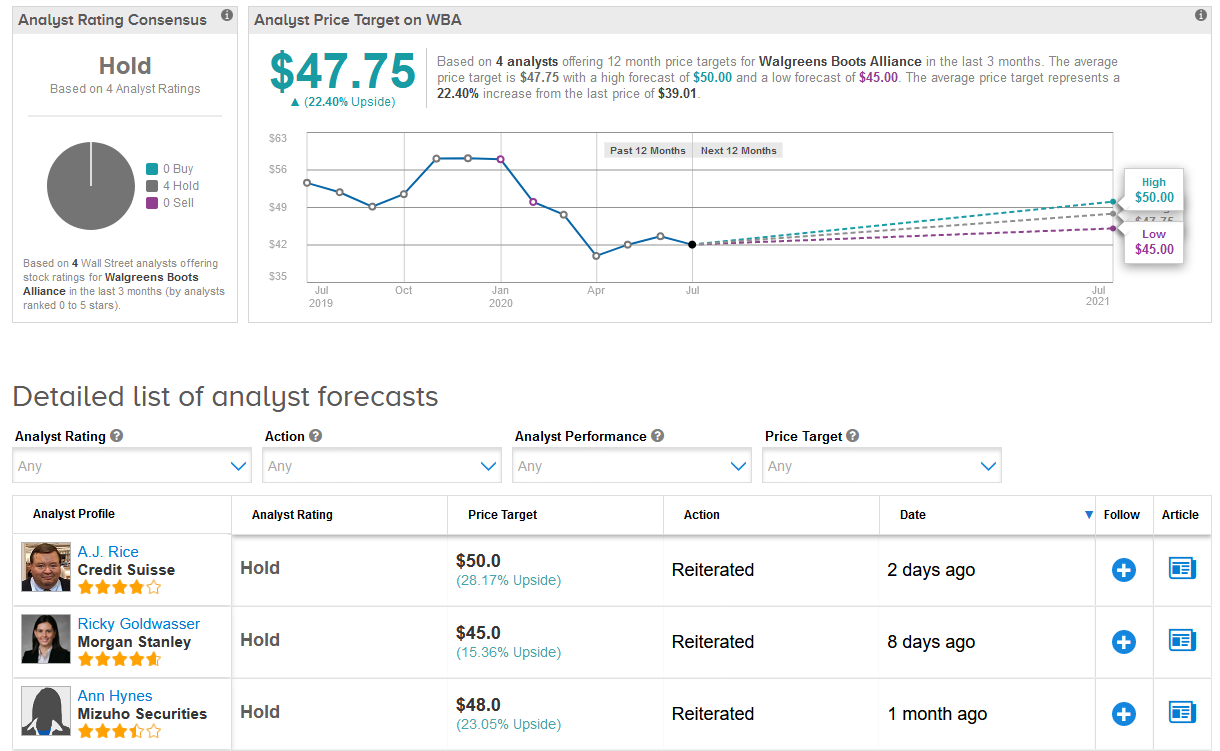

With Walgreens’ stock down now 34% year-to-date, analysts are sidelined on the stock. The Hold analyst consensus shows an unanimous 4 Hold ratings. Looking ahead, the $47.75 average price target implies 22% upside potential from current levels. (See Walgreens stock analysis on TipRanks).

Morgan Stanley analyst Ricky Goldwasser earlier this month cut the stock’s price target to $45 from $49 and reiterated a Hold rating, saying that investors are weighing whether, or not the challenges the company is exposed to are valued into the shares.

Goldwasser remains cautious for now and lowered her full-year per share earnings forecast by 8 cents to $5.48. The analyst expects Walgreens to report EPS of $1.16 in the fourth quarter, which is slightly below consensus estimates.

Related News:

Costco June Sales Beat Estimates As Shoppers Go Online; Top Analyst Raises PT

Lookout Walmart, Amazon Is Coming for Your Grocery Customers, Says Analyst

Walmart To Launch Online Subscription Service For $98 Per Year- Report