Retail pharmacy leader Walgreens Boots Alliance, Inc. (NASDAQ: WBA) reported upbeat first-quarter Fiscal 2022 results (ended November 30) and provided updated guidance for Fiscal 2022. Strong demand for COVID-19 vaccines and tests drove the results.

Despite the beat, shares of the company closed 2.9% lower at $52.44 on Thursday after management warned of increasing labor costs.

Results in Detail

The company reported adjusted earnings of $1.68 per share, which comfortably beat the consensus estimate of $1.33 per share and jumped 53.1% year-over-year.

Additionally, total sales of $33.9 billion grew 7.8% year-over-year and topped analysts’ expectations of $32.74 billion. Strong comparable sales growth at Walgreens and in the International segment acted as tailwinds.

During the first quarter, Walgreens administered 15.6 million vaccinations and 6.5 million tests.

Segmental Details

The United States segment recorded sales of $28 billion, up 3.2% year-over-year, while comparable sales rose 7.9%.

Furthermore, the International segment’s sales surged 35.8% to $5.8 billion, including a favorable currency impact of 1.6%. Also, Boots U.K.’s comparable pharmacy sales increased 8.8% year-over-year, reflecting higher demand for pharmacy services.

Notably, along with the launch of its new consumer-centric healthcare strategy, in Fiscal 2022, the company created a new operating segment, Walgreens Health, which reported sales of $51 million in the first quarter.

Official Comments

In response to the first-quarter results, Walgreens Boots Alliance CEO Rosalind Brewer said, “First quarter results exceeded our expectations, with a very encouraging performance across all our business segments…Our majority investments in VillageMD and Shields closed during the quarter, and we’re rolling out VillageMD primary care co-locations and Walgreens Health Corners at pace. The strong start to the fiscal year reinforces our confidence in the future, and as a result, we are raising our guidance for the full year and increasing investments in our people.”

Guidance

To reflect the encouraging first-quarter performance and continued positive momentum, Walgreens Boots Alliance increased adjusted EPS guidance for Fiscal 2022 to low-single-digit growth, from flat previously.

Notably, the guidance includes the 4 percentage point negative impact from previously planned healthcare investments.

Sales in the U.S. are expected to improve, driven by strength in both pharmacy and front of store. Additionally, international sales growth is likely to be in the range of 9% to 11%, primarily due to improved market growth in the German wholesale business.

Wall Street’s Take

Overall, the stock has a Hold consensus rating based on 1 Buy, 5 Holds, and 1 Sell. The average Walgreens Boots Alliance price target of $54.86 implies 4.61% upside potential. Shares have jumped 20.4% over the past year.

Risk Analysis

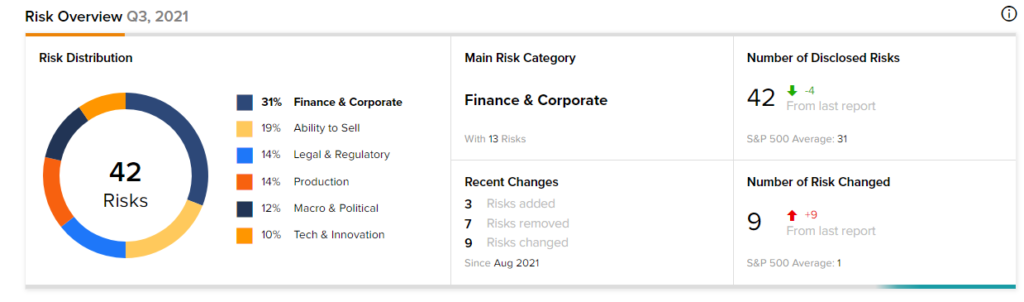

According to the new TipRanks Risk Factors tool, Walgreens Boots Alliance stock is at risk mainly from three factors: Finance and Corporate, Ability to Sell, and Legal & Regulatory, which contribute 31%, 19%, and 14%, respectively, to the total 42 risks identified for the stock.

Download the TipRanks mobile app now

Related News:

Costco Reports Sales Numbers for December

Pfizer & BioNTech Ink Collaboration Deal to Develop mRNA-based Vaccine for Shingles

Ford’s U.S. Sales Decline; Shares Fall