Construction materials company Vulcan Materials (NYSE:VMC) has alleged that Mexican security forces, along with Mexican cement company Cemex (NYSE:CX), illegally took possession of its port terminal in southern Mexico last week, Reuters reported. Vulcan is involved in an extended legal battle with the authorities over its limestone mining activities.

Pick the best stocks and maximize your portfolio:

- Discover top-rated stocks from highly ranked analysts with Analyst Top Stocks!

- Easily identify outperforming stocks and invest smarter with Top Smart Score Stocks

The Mexican government is allegedly seeking Vulcan’s property for shipping and tourism purposes. “We are shocked in Cemex and in the Mexican government entities that supported this reckless and reprehensible armed seizure of our private property,” the company said in a statement.

Vulcan added it could not quarry and ship construction aggregate since last year, as the Mexican government decided to “illegally” shut down its operations. The Mexican government had cited concerns over the harmful impacts of underwater limestone mining on the local environment and water table for shutting down the operations.

While Mexico’s security ministry declined to comment, Cemex contended that its action last week was supported by a local court and a recent order from state prosecutors that granted it access to the port terminal. Note that Cemex had a contract with a local Vulcan unit, about two decades back, which as per the company allowed it to use the terminal. Cemex also stated that its move followed months of failed negotiations with Vulcan.

Meanwhile, U.S. senator Katie Britt, a Republican from Alabama, issued a statement condemning the seizure of Vulcan’s property as “unlawful and unacceptable.” Britt added, “It is shameful that this Mexican presidential administration would rather confiscate American assets than the fentanyl killing hundreds of Americans per day.” Britt urged U.S. President Joe Biden to raise this matter directly with Mexican President Andrés Manuel López Obrador.

Should Investors Buy VMC Stock?

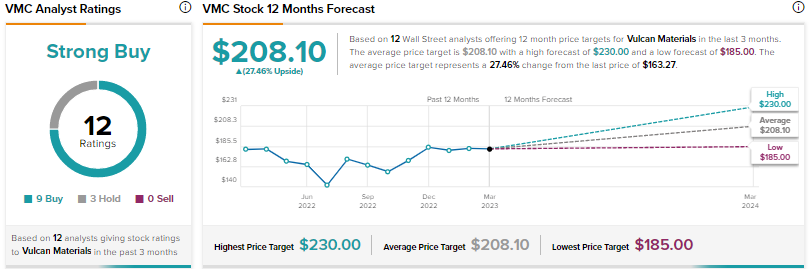

Wall Street has a Strong Buy consensus rating for Vulcan Materials based on nine Buys and three Holds. The average VMC stock price target of $208.10 implies 27.5% upside.

In addition to its Strong Buy rating, VMC stock holds a Smart Score of 10, meaning it’s likely to outperform the market.