Investors will be watching future Vulcan Energy Resources (VUL) project updates closely, after its stock surged more than 13% Monday, on the back of high grade results at its Zero Carbon Lithium Project in Germany.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

The Australian based lithium business announced it’s produced the highest grade, lowest impurity lithium hydroxide to date from its pilot plant.

Innovative lithium production

The company states that its unique Zero Carbon Lithium Project aims to decarbonise lithium production, through developing the world’s first carbon neutral, zero fossil fuels business, with the co-production of

renewable geothermal energy on a mass scale.

“The technology will help the industry move away from large open pit mines, and large water-hungry evaporation ponds, or process plants running on fossil fuels,” states the company.

By adapting existing technologies to efficiently extract

lithium from geothermal brine, the company states it’s aiming to deliver a local source of sustainable lithium for Europe, built around a net zero carbon strategy with a strict exclusion of fossil fuels.

Is Vulcan Energy a good buy?

The promising project results will be welcome relief for Vulcan’s existing shareholders, which have seen the stock drop more than 35% so far this year, despite lithium demand and prices soaring.

Despite missing out on the uplift, the trend bodes well for the Zero Carbon Lithium Project’s prospects, as it moves towards the stated aim of first commercial production in 2025.

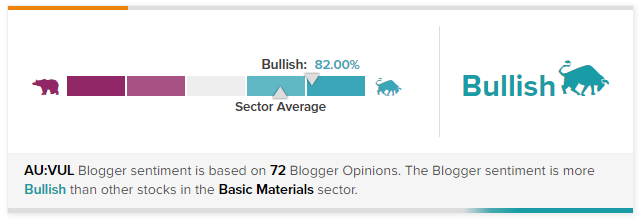

Vulcan Energy is a Moderate Buy, with one Buy rating, which comes from Reg Spencer, a highly rated analyst from Canaccord Genuity. The price target of AU$19 implies an upside of more than 175%.

Vulcan shares are receiving positive coverage on financial blogs. TipRanks data shows that financial blogger opinions are 82% Bullish on the stock, higher than the sector average.

Final thoughts

While Vulcan Energy stock hasn’t seen the same uplift as many other lithium focussed businesses so far this year, the positive results for the Zero Carbon Lithium Project provide confidence going forward. Shareholders will be hoping that strong lithium demand and prices endure for the project’s date of first production, slated for 2025.