Shares of VTEX (VTEX) were down 3.4% in Tuesday’s extended trading session after the company delivered mixed debut second-quarter earnings results since its IPO in July. Shares of VTEX have jumped 14.2% since its IPO. (See VTEX stock charts on TipRanks)

VTEX, with a market capitalization of about $4.74 billion, is an enterprise digital commerce platform that allows brands and retailers to transform digitally at a faster speed and reach their customers across any channel, thereby opening new growth areas.

The company reported an adjusted loss of $0.09 per share in Q2 versus earnings of $0.03 per share in the prior-year period.

On a positive note, revenues jumped 22.1% year-over-year to $30.9 million compared to $25.3 million in the prior-year quarter. The increase in revenues reflected a 23.9% surge in subscription revenues.

VTEX co-CEO Mariano Gomide de Faria said, “We are focused on transforming the future of ecommerce. We expect to continue to enhance our leadership position in Latin America through strong execution and focus.”

Faria added, “We are only at the beginning of the digital commerce journey and VTEX is here to accelerate it.”

Looking forward, the company provided third-quarter and full-year revenue guidance.

For Q3, the company forecasts revenues to be in the range of $31 – $31.5 million, while for the full-year 2021, revenue is estimated to range between $124 million and $126 million.

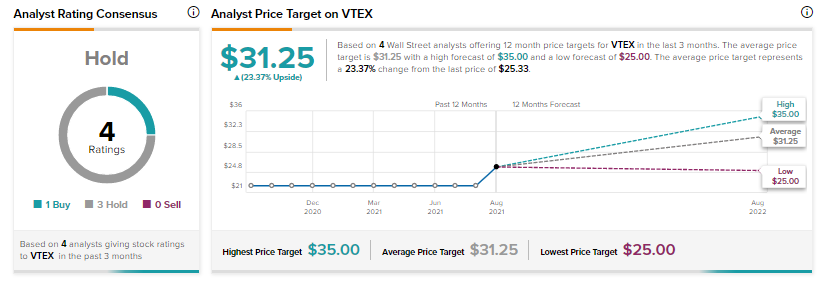

Ahead of the Q2 results, KeyBanc analyst Josh Beck initiated coverage of VTEX with a Buy rating and a price target of $35 (38.2% upside potential).

Beck is impressed with VTEX’s advantageous competitive positioning as well as its powerful unit economics. He believes that the company’s e-commerce software platform promotes “disruptive orchestration and low-code software principles, which is poised for sustained share gains.”

Overall, the stock has a Hold analyst consensus rating based on 1 Buy and 3 Holds. The average VTEX price target of $31.25 implies 23.4% upside potential from current levels.

Related News:

Endeavor Group Posts Mixed Results in Q2; Shares Rise

Lightning eMotors Shares Crash 14.3% on Q2 Loss, Withdraws FY2021 Guidance

GAN Posts Mixed Q2 Results; Shares Drop 8%