Finacial services major Visa Inc. (V) recently announced that it plans to expand its presence in Atalanta. The move will include opening a new office there next year.

Following the news, shares of the company appreciated marginally to close at $227.10 in extended trade on Wednesday.

The new office will be located at 1200 Peachtree Street in Midtown Atlanta. The office will see several global and regional leaders of the company relocating to Atlanta. Further, the office will cover a wide range of Visa operations with special emphasis on technology and client services teams.

Besides setting up a new office, Visa will also look to empower local businesses, especially female and Black-owned small businesses, with resources and technology. To offer this support, Visa will partner with the Georgia Fintech Academy and Advanced Technology Development Center at Georgia Tech to assist entrepreneurs in creating solutions to enable the future of payments, financial services and commerce.

The Head of the U.S. Market at Visa, Kim Lawrence, said, “Growing our presence and workforce in Atlanta will enable Visa to serve our clients more effectively, support talent development and contribute to the long-term success of local communities.” (See Visa stock chart on TipRanks)

Recently, Bank of America Securities analyst Jason Kupferberg reiterated a Buy rating on the stock with a price target of $279, which implies upside potential of 23.1% from current levels.

The analyst said, “Management mentioned that the level of recovery in cross-border travel in the month of August was the biggest upside surprise relative to internal expectations, as this metric improved 4pts in August (relative to 2019) compared to July trends. We were encouraged to hear that outbound travel in most parts of the world has returned to pre-COVID levels (i.e., Americans traveling outside of the US and Europeans traveling outside of Europe). However, Asia has been slow to recover (both domestically and x-border) given tighter virus restrictions and more stringent border controls.

“V is optimistic with regard to the planned reopening of US borders to vaccinated travelers from outside of the US starting in November, which we believe could further accelerate the recovery in x-border vols/revs for V, as inbound US travel accounts for a significant part of V’s cross-border travel business and is among the highest yielding.”

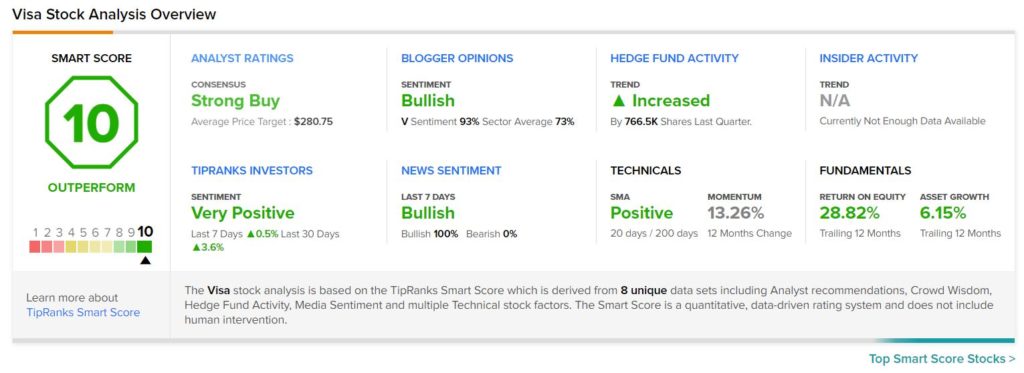

Consensus among analysts is a Strong Buy based on 19 Buys and 1 Hold. The average Visa price target of $280.75 implies upside potential of 23.9% from current levels.

Visa scores a “Perfect 10” from TipRanks’ Smart Score rating system, indicating that the stock has strong potential to outperform market expectations. Shares have gained 13.4% over the past year.

Related News:

Mastercard Unveils Buy Now, Pay Later Program

Navient Announces Plan to Exit Federal Student Loan Servicing Contract

Square, TikTok Launch Square x TikTok to Help Businesses