Payments major Visa Inc. (NYSE: V) posted better-than-expected results for the third quarter ended June 30, 2022. The solid results were primarily driven by the yearly growth witnessed in both revenue and earnings.

Following the earnings, shares of the company declined marginally to close at $212 in yesterday’s extended trade. The slight decrease could be attributed to wider market concerns.

Revenue and Earnings See Impressive Growth

Visa reported quarterly net revenues of $7.3 billion, which represents a growth of 19% from the previous year. Further, the figure outpaced the consensus estimate of $7.08 billion.

The company’s earnings per share (EPS) for the quarter came in at $1.98, a growth of 33% from the prior year. Moreover, the figure surpassed the consensus estimate of $1.75.

Operating Metrics Paint a Positive Picture

Visa’s operating income rose 2.1% from the previous year to $4.1 billion.

Payments volume and total cross-border volume increased by 12% and 40% year-over-year, respectively, while processed transactions grew by 16% from the previous year.

The company ended the quarter with a cash, cash equivalent, and investment securities balance of $19.6 billion.

Capital Deployment Activities

In the third quarter, Visa repurchased 12.2 million shares of class A common stock at an average price of $202.16 per share for $2.5 billion.

Moreover, on July 22, the company declared a quarterly cash dividend of $0.375 per share. The dividend will be paid on September 1, 2022, to shareholders of record as of August 12, 2022.

Management’s Commentary

CEO of Visa, Alfred F. Kelly, Jr. said, “Sustained levels of growth in overall payments volume, cross-border volume and processed transactions demonstrated the resiliency of our business model. Consumers are back on the road, visiting various corners of the world, resulting in cross-border travel volume surpassing 2019 levels for the first time since the pandemic began in early 2020. While the economic outlook is unclear, we remain confident in our ability to execute with discipline and expand Visa’s role at the center of money movement.”

Wall Street’s Take

Consensus among analysts is a Strong Buy based on 17 Buys and 2 Holds. The V average price target of $256.22 implies upside potential of 20.6% from current levels. Shares have declined 15.3% over the past year.

Investors Loading up on Visa Stock

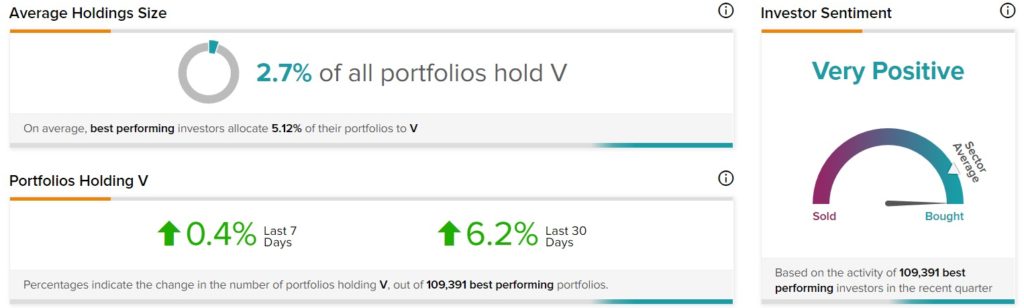

TipRanks’ Stock Investors tool shows that top investors currently have a Very Positive stance on V. Further, 6.2% of the top portfolios tracked by TipRanks, increased their exposure to V stock over the past 30 days.

Final Thoughts

Despite exiting the Russian business due to geopolitical tensions, Visa’s strong results for the third quarter were impressive. Both revenue and earnings recorded solid growth from the previous year, demonstrating the company’s operational efficiency.

However, the impending recession remains a cause of concern for the company.

Read full Disclosure