Intimates specialty retailer Victoria’s Secret & Co. (NYSE: VSCO) provides its products through stores and online globally.

With strong execution and brand revolution, the company seems to have navigated through the current challenging macroeconomic environment.

Recently, Victoria’s Secret posted upbeat results for the first quarter of Fiscal 2022. Additionally, it provided a decent outlook for the July quarter.

Following the update, shares of the company rose 7.3% in the extended trading session on Tuesday after declining 3.42% at the close.

Results in Detail

Net sales of $1.48 billion decreased by 4.5% on a year-over-year basis. However, the figures came in above the analysts’ expectations by $10 million. Meanwhile, total comparable sales plunged 8% year-over-year.

Victoria’s Secret registered first-quarter adjusted earnings per share of $1.11, above the consensus estimate of $0.84. Also, earnings came in above the company’s guidance range of $0.70 to $0.95 per share. The company reported adjusted earnings of $1.97 per share in the same quarter last year.

Adjusted operating income stood at $115.8 million, down 48.7% year-over-year. Aggravated supply chain challenges acted as headwinds.

During the first quarter, the company repurchased 2.2 million shares for a total cost of around $110 million.

Outlook

For Fiscal Q2 2022, the company projects sales to be up low-single-digits to down low-single-digits on a year-over-year basis. Operating income is expected to be in the range of $125 million to $155 million, while EPS to land between $0.95 and $1.25.

CEO’s Comments

Commenting on the results, Victoria’s Secret CEO Martin Waters said, “As a result of our deliberate actions, we have stabilized the business and delivered over $1 billion in EBITDA for the trailing twelve-month period.”

Looking forward, “We are well prepared to continue to address macro challenges through merchandise and marketing that delights our customers, new business initiatives designed to expand our customer base and grow sales, and disciplined financial management,” Waters added.

Wall Street’s Take

Consensus among analysts is a Strong Buy based on 6 unanimous Buys. The average Victoria’s Secret price target of $74.80 implies 81.51% upside potential from current levels. Meanwhile, shares have lost more than 3% over the past year.

Website Traffic

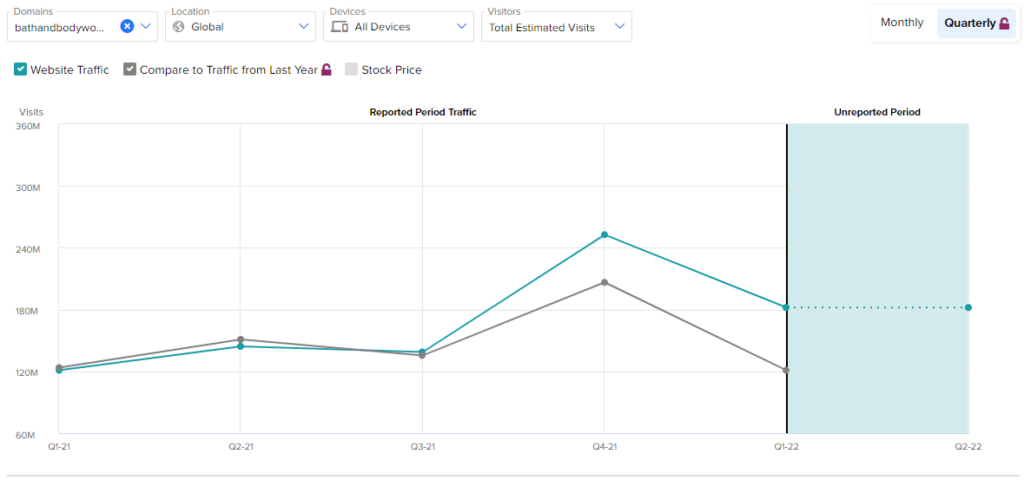

The earnings results were evident on TipRanks’ new tool that measures visits to Victoria’s Secret’s website. Pre-earnings, we were able to see insights into the company’s performance in the quarter ended April 2022.

According to the tool, a website traffic uptrend was visible. In Fiscal Q1 2022, total estimated visits on Victoria’s Secret’s website showed an increasing trend, on a global basis, representing a 50.3% jump from the prior-year quarter.

The predictions that were based on TipRanks’ website visits data turned out to be correct, with Victoria’s Secret reporting strong results in Fiscal Q1 2022.

Concluding Remarks

Currently, trading near its 52-week low price, Victoria’s Secret has lost 26.6% so far this year. As a result, investors purchasing the dips may choose to explore the company, which has performed well over the last year and is well-positioned in the industry.

Also, vigilance on website trends reflected on TipRanks’ Website Traffic Tool could assist in taking a wise decision.

Read full Disclosure