V.F. Corporation (VFC) reported Q4 adjusted earnings of $0.27 per share ($0.06 contributed from acquisitions), up 169% from the prior-year period, but shy of the Street’s estimates of $0.29 per share. Shares of the retailer plunged 9% to close at $77.24 on May 21.

Revenue for the quarter came in at $2.58 billion, up 23% from the year-ago period (up 16% excluding acquisitions), and surpassed the Street’s estimates of $2.5 billion.

VF is a global leader in branded lifestyle apparel, footwear, and accessories.

For FY21, revenue was down 12% at $9.24 billion and adjusted earnings were down 51% at $1.31 per share.

Compared to the prior year, the company’s full-year segmental revenue in Outdoor recorded a decline of 11% , Active revenue fell 15%, and Work revenue increased 7%. The decline was mainly due to store closures related to COVID-19 government regulations and reduced consumer demand. (See V.F. Corp stock analysis on TipRanks)

Steve Rendle, Chairman, President and CEO of the company said, “I could not be more pleased with how our organization navigated fiscal 2021 … Early in the year we took important actions to protect our people and the enterprise … we took bold, forward-looking actions to spark additional growth and value creation. As a result, we are exiting this year in a position of strength with broad based momentum across the portfolio.”

For FY22, the company projects revenue and EPS of $11.8 billion and $3.05 per share, versus consensus estimates of $11.41 billion and $3.02 per share respectively. The Supreme brand is expected to contribute $600 million to FY22 revenue and $0.25 per share towards EPS.

Anticipating a strong performance from VFC in the fourth quarter, Pivotal Research analyst Mitch Kummetz reiterated a Buy rating on the stock and lifted the price target to $100 from $94, which implies 29.5% upside potential from current levels.

Commenting on the upgrade, Kummetz said, “Our proprietary research bodes well for VFC. First, February was a cold month, which likely drove strong TNF and Timberland reorders. Second, March and April were extremely strong months at retail, helped by stimulus. Third, TNF and Timberland fall 2021 prebooks are likely better than a year ago.”

Overall, the stock has a Strong Buy consensus rating based on 5 unanimous Buys. The average analyst price target of $101.20 implies 31% upside potential from current levels. Shares have gained 29.1% over the past year.

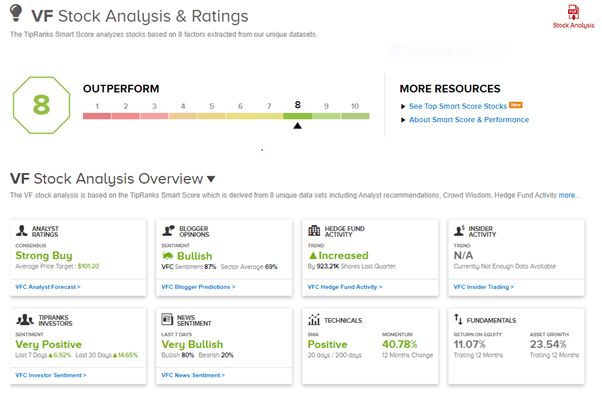

V.F. Corp scores an 8 of 10 from TipRanks’ Smart Score rating system, indicating that the stock has strong potential to outperform market expectations.

Related News:

CP Rail Pursues Kansas City Takeover in Case the CN Deal Falls Through

Newtopia Revenue Falls 33% in the First Quarter; Shares Jump 4%

Ares Subsidiary to Snap Up Assets of Black Creek, Expects 29B in AUMs