Canada-based Vermilion Energy, Inc. (TSE: VET) has reported upbeat results for the second quarter of 2022 and updated its guidance for the third quarter.

What Does Vermilion Energy Do?

Headquartered in Alberta, Vermilion Energy is engaged in the exploration, acquisition, development, and production of oil and natural gas in Europe, North America, and Australia. Out of the total corporate production, North American assets account for around 60%, European assets represent nearly 35% and Australian assets contribute the remaining 5%.

A Snapshot of Vermilion Energy’s Q2 Results

Fund flow from operations (FFO) increased 16% quarter-over-quarter to C$453 million, driven by higher commodity prices. Free cash flow (FCF) grew 12% to C$340 million.

Earnings came in at C$2.20 per share, higher than the previous quarter’s figure of C$1.75 per share and the Street’s estimate of C$1.67 per share.

Total production declined 2% quarter-over-quarter to 84,868 barrels of oil equivalent per day (boe/d). Production from International operations fell 9% to 26,840 boe/d, which was partially offset by a 3% rise in production from North American operations to an average of 58,027 boe/d.

Further, Vermilion raised its third-quarter dividend by 33% to eight cents per share. It also plans to return up to 25% of its FCF to the shareholders in the second half of the year and between 50% and 75% next year.

Meanwhile, for the full-year 2022, the company expects producing 86,000 and 88,000 boe/d.

Is Vermilion Energy a Good Buy?

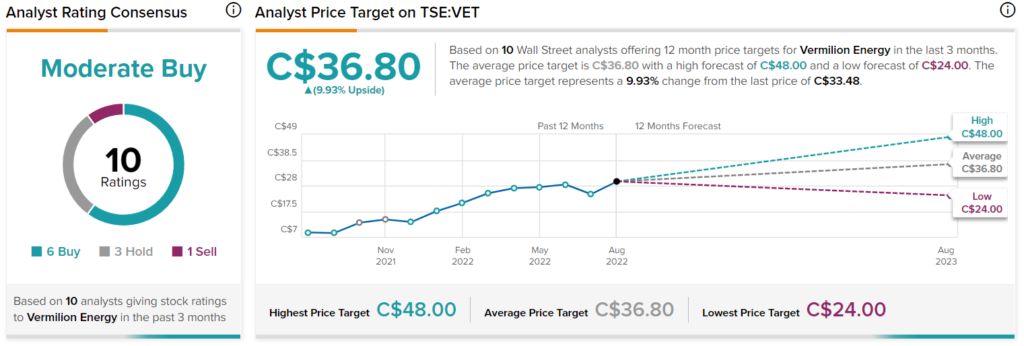

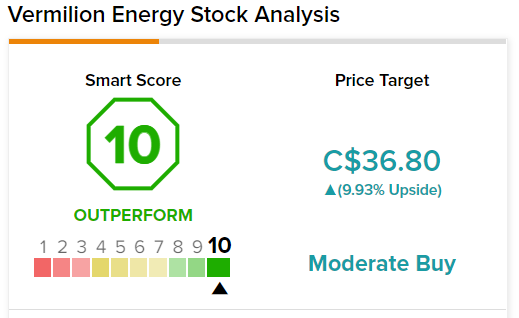

Analysts are both cautious and optimistic about Vermilion Energy. On TipRanks, Vermilion Energy has a Moderate Buy consensus rating, which is based on six Buys, three Holds, and one Sell. VET’s average price target of C$36.80 implies almost 10% upside potential to current levels.

The company has performed well over the past couple of quarters and, as a result, distributed profit in the form of dividends. It has also been working towards reducing its debt and boosting its FCF, thus, making it a stock worth considering. However, Vermilion Energy’s current share price is very close to its 52-week high. Investors might want to wait for the price to fall before buying the stock.

According to TipRanks’ Smart Score rating system, Vermilion Energy scores a “Perfect 10,” implying that the stock has strong potential to outperform the market.

Read full Disclosure