Shares of Verizon Communications Inc. (VZ) rose 2.4% to close at $53.61 on Wednesday after the American multinational telecommunications company recorded upbeat third-quarter earnings. The positive results were driven by the accelerated adoption of 5G-capable devices. Revenue figures, however, missed analysts’ expectations during the quarter.

The company reported adjusted earnings of $1.41 per share in the third quarter, which compared favorably with the income of $1.25 per share recorded in the same quarter last year. Adjusted earnings also significantly beat analysts’ expectations of $1.36 per share.

At the same time, adjusted operating revenue rose 5.5% year-over-year to $32.9 billion but missed the consensus estimate of $33.2 billion. Additionally, wireless service revenue came in at $17.1 billion, up 3.9%.

In the third quarter, consumer revenues were $23.3 billion, up 7.3% year-over-year, mainly driven by robust demand for connectivity and products. Notably, the quarter recorded 423,000 wireless retail postpaid net additions.

See Analysts’ Top Stocks on TipRanks >>

However, business revenues were marginally down to $7.7 billion due to a decline in ongoing legacy wireline, partly offset by wireless revenue growth. Markedly, the business recorded 276,000 wireless retail postpaid net additions in the quarter.

Capital expenditures year-to-date came in at $13.9 billion, which continue to support the growth in traffic on the company’s 4G LTE network and aid the continued expansion of the company’s 5G Ultra Wideband and 5G Nationwide networks. (See Verizon stock charts on TipRanks)

Looking ahead, the CEO of Verizon, Hans Vestberg, said, “Our disciplined strategy execution demonstrated growth in 5G adoption, broadband subscribers and business applications. We are increasing our 2021 guidance, and we continue to expand our 4G LTE and 5G network leadership. We fully expect to have a strong finish to the year as we accelerate deployment of 5G to our customers across the country.”

For 2021, the company now projects adjusted EPS to be in the range of $5.35 to $5.40 per share, up from the prior expectations of $5.25 to $5.35 per share. The consensus estimate is pegged at $5.31 per share.

Additionally, total wireless service revenue growth is expected to be about 4% for the year. Furthermore, capital spending is projected to be in the range of $17.5 billion to $18.5 billion.

Prior to the third-quarter results, Deutsche Bank analyst Bryan Kraft resumed coverage of Verizon with a Hold rating and a price target of $55 (2.6% upside potential).

From a dividend yield perspective, Kraft considers Verizon to be attractive, but based on his growth expectations, he expects about 5% upside potential to the stock price over the next year.

The rest of the Street is cautiously optimistic about the stock and has a Moderate Buy consensus rating based on 3 Buys versus 5 Holds. The average Verizon price target of $60.13 implies 12.2% upside potential to current levels. Shares have decreased 5.5% over the past year.

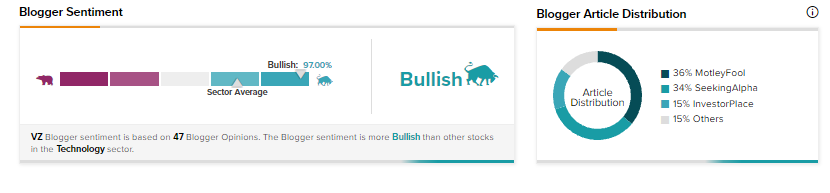

Bloggers are enthusiastic about Verizon. TipRanks data shows that financial blogger opinions are 97% Bullish on VZ, compared to a sector average of 71%.

Related News:

Commerce Bancshares’ Q3 Results Beat Analysts’ Expectations

Greenlane Inks Deal to Buy DaVinci; Shares Drop

Synovus’ Q3 Earnings Top Estimates; Shares Gain