Is McDonald’s (MCD) no longer a cheap place to eat? That seems to be the message U.S. consumers are picking up on, as the company recently reported its weakest comparable sales growth in five years. Adding to this poor domestic performance, the company reported mixed results in Q1, leading to a less-than-optimistic outlook, citing macro trends as the cause.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 55% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Paradoxically, the stock has held up well, which aligns with its usual investment appeal, given McDonald’s history of being insulated from a weak consumer environment. However, in my view, resilience is not entirely justified considering the bearish trends over the last three quarters and the cautious tone of management regarding the tough macro backdrop ahead.

That said, I believe the market’s optimism is exaggerated, as it fails to fully account for the bumpy growth ahead, especially regarding the bottom line. McDonald’s may need to offer more discounts to drive traffic. With its premium valuation compared to peers and a very narrow margin of safety, I expect the stock to underperform. For now, I would lean toward a bearish stance.

McStumble in the U.S.

Domestic demand weakness, brand damage from aggressive pricing, and a consumer pullback at the low end seem to be the three key takeaways from McDonald’s most recent earnings report. The Golden Arches has now hit a rough patch for three consecutive quarters, with comparable sales slipping due to broad industry headwinds and fierce price competition—especially from grocery stores.

You’d think McDonald’s, known for its affordable menu, would benefit from a weaker consumer environment as people trade down. But the opposite has happened—particularly in its home market.

In the U.S., where McDonald’s generates the bulk of its profits, the company saw a 3.6% year-over-year decline in same-store sales, its worst performance in five years. Consolidated revenue fell 3% YoY to $5.96 billion, and diluted EPS dropped 2% to $2.60—both of which missed analyst expectations.

This weakness is tied mainly to a steep drop in visits from lower-income consumers (those earning under $50,000/year), who are clearly pulling back. And unfortunately, that’s a core demographic for McDonald’s.

One likely culprit? Steep price hikes—menu prices have surged nearly 40% since COVID, hurting the brand’s value perception. Efforts like the “MCV Value” platform (Buy-One-Get-One for $1) may have helped traffic a bit, but came at the cost of lower average checks. As a result, McDonald’s total net income shrank 3% for the quarter.

All in all, there’s been little visible progress in reigniting growth in the core business. Management’s turnaround plan now centers around reintroducing $5 combo meals, premium chicken strips, and the return of the McWrap—but these are still future-oriented plays, not immediate fixes.

McDonald’s Is Beating the Market, But For How Long?

Honestly, it feels like despite some pretty weak results—especially in the domestic market—McDonald’s stock has held up surprisingly well compared to the broader market. Maybe even better than it deserves to, in my view.

As it stands, McDonald’s shares have outperformed the choppy S&P 500 (SPY) by a fair margin this year. This, even as CEO Chris Kempczinski openly acknowledged that the recent drop in comparable sales reflects consumers “grappling with uncertainty”—even though, in theory, McDonald’s is supposed to thrive in that kind of environment, given its focus on lower-income customers.

That’s why the tone of the latest earnings call was so cautious about the macro landscape. Management hinted that middle-income consumers are also starting to feel the pinch, which means McDonald’s traffic could remain under pressure for the rest of the year.

It is so much so that expectations for EPS and revenue growth over the next two years (including the current one) have barely moved—a quiet admission that the turnaround story is still pretty soft and lacking real momentum.

How Attractive is McDonald’s Stock Right Now?

McDonald’s stock currently trades at a 25x forward earnings multiple. If you look at its operating profit in relation to its enterprise value, it offers an earnings yield of 4.3%. This clearly puts McDonald’s at a premium compared to the broader market, which typically trades at around ~15x earnings.

That premium, however, is only really justified by a few factors, like its steady (albeit small) dividend yield of around 2.2% and the defensive nature of its business. This requires McDonald’s to deliver consistent cash flows, pricing power, and brand resilience, even in a tough economic environment. But, honestly, I don’t think McDonald’s has fully delivered on the latter two in recent quarters.

On top of that, a 4.3% earnings yield isn’t especially attractive when you compare it to alternative investments, like risk-free government bonds. For example, the 10-year U.S. Treasury bond also yields around 4.3%. This makes McDonald’s stock less compelling unless you have strong confidence in the company’s ability to boost earnings growth and win market share again.

So, while the estimated total return—combining a 10.4% earnings 5-year CAGR with a 2.2% dividend yield—might justify McDonald’s current 25x earnings multiple, it’s important to note that there’s not much of a margin of safety here. The case for McDonald’s hinges on consistent execution, maintaining its pricing power, and seeing real earnings growth, especially in this tough macroeconomic environment. With the stock’s earnings yield practically matching the yield on 10-year government bonds, investors are taking on equity risk without an explicit return premium.

Is McDonald’s Stock a Good Buy?

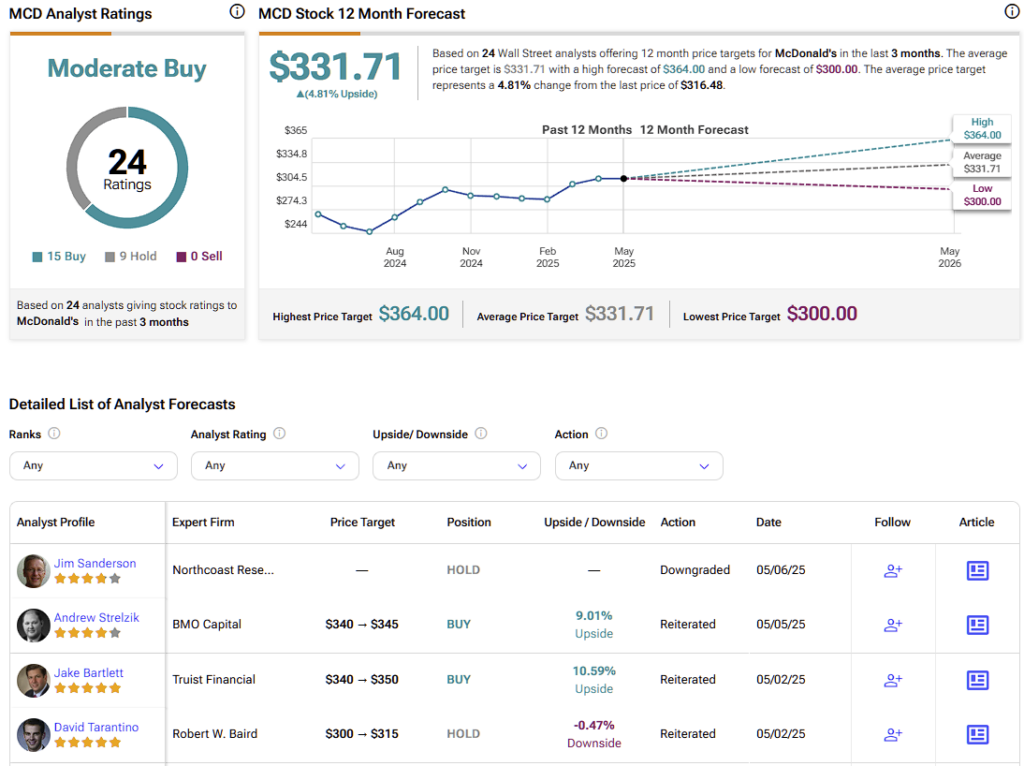

Overall, analysts have a moderately optimistic outlook on McDonald’s stock. Out of 24 Wall Street analysts covering the company, 15 have a Buy rating, and nine recommend a Hold. Not a single analyst rates MCD as a Sell. MCD’s average price target is $331.71, suggesting an upside potential of about 4.8% from the current price.

Not So Happy Meal for Investors

While some of McDonald’s recent challenges may be viewed as cyclical (due to inflation, economic downturns, or temporary shifts in consumer behavior), there are signs that deeper, possibly structural issues are at play.

The brand’s value proposition is being questioned, particularly among its core low-income customer base. Additionally, the company’s pricing strategy may be driving away key demographics. If McDonald’s can’t adjust its pricing and improve its perception, it could face long-term difficulties that go beyond temporary economic conditions. So, it seems there could be structural problems, especially regarding pricing and brand perception among its core consumers.

That said, McDonald’s premium valuation might be based on overly optimistic projections, but it doesn’t leave much room for safety for investors looking for a “safe” bet. Even in a scenario where McDonald’s should theoretically benefit from its reputation for affordability during tough economic times, the company has still struggled.