Vail Resorts (MTN) announced better-than-expected fiscal third-quarter results. The company is a global mountain resort operator.

The company’s revenues of $889.1 million surpassed the Street’s estimates of $882.1 million and jumped 28.1% from the year-ago period.

Earnings came in at $6.72 per share, beating consensus estimates of $6.47 per share and soared 79.7% year-over-year.

Commenting on the outlook for fiscal 2021, the CEO of Vail Resorts, Rob Katz, said, “Net income attributable to Vail Resorts is expected to be between $93 million and $139 million for fiscal 2021. We expect that Resort Reported EBITDA for fiscal 2021 will be between $530 million and $570 million, and we expect that Resort Reported EBITDA Margin for fiscal 2021 will be approximately 28.9%, using the midpoint of the guidance range.”

He added, “The outlook for the fiscal year 2021 is predicated on the current Canadian and Australian foreign exchange rates of $0.82 and $0.78, respectively, for each currency to the U.S. dollar for the rest of the fiscal year.” (See Vail Resorts stock analysis on TipRanks)

Following the fiscal Q3 earnings release, Deutsche Bank analyst Chris Woronka reiterated a Hold rating on the stock but increased his price target to $298 from $294. This implies 10.9% downside potential to current levels.

Woronka commented, “We believe the new pricing strategy should indeed allow MTN to move closer to its goal of having 75% of lift revenue derived from pass sales before the ski season begins. Despite this impressive early result, we continue to see shares as fairly to fully valued.”

The rest of the Street is cautiously optimistic about the stock with a Moderate Buy consensus rating based on 2 Buys and 6 Holds. The MTN average analyst price target of $324.13 implies 3% downside potential. Shares have increased almost 16% over the past six months.

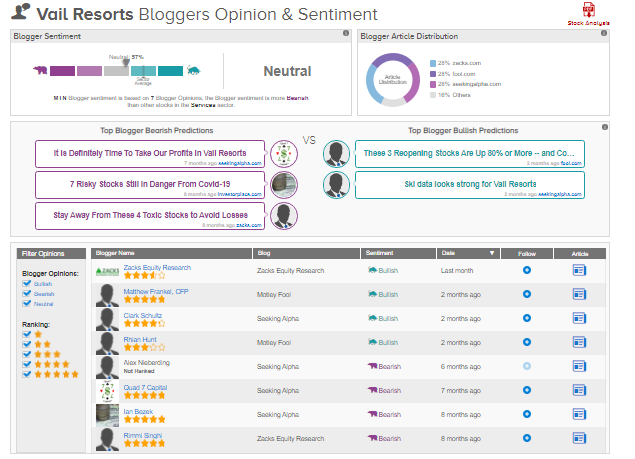

TipRanks data shows that financial blogger opinions are 57% Neutral on MTN, compared to a sector average of 70%.

Related News:

BorgWarner Completes Tender Offer For 89% Stake in AKASOL

Asana Delivers Smaller-Than-Expected Q1 Loss, Revenue Beats Estimates

ChargePoint Posts Q1 Loss, Beats Revenue Estimates